Alumis (ALMS) Spikes 40%: Why I Shorted the Overnight Gap Ahead of Data

And it wasn't a very good idea!

The biotech market is a dangerous place to chase momentum, yet that is exactly what we saw during overnight trading with Alumis Inc. (ALMS). The stock surged roughly 40% simply on the news of an upcoming conference call to discuss Phase 3 topline data for its plaque psoriasis candidate, envudeucitinib (ESK-001). While the retail crowd sees a breakout, I see a classic "buy the rumor" trap. Consequently, I took a contrarian stance and initiated a short position at avg. of $10.97 during the overnight session. It’s a bold move into a binary event, and I fully acknowledge I could be wrong—if Alumis produces data that is truly revolutionary, the stock could run further. However, my thesis isn't based on their failure; it's based on the irrelevance of their success.

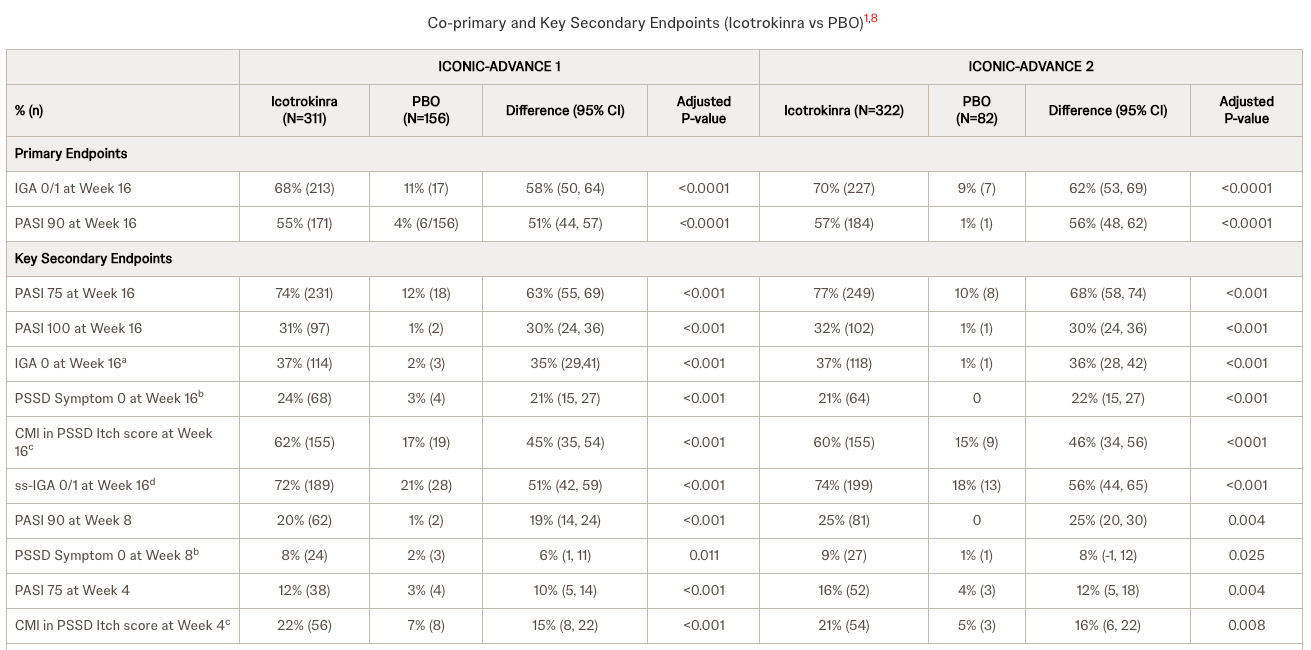

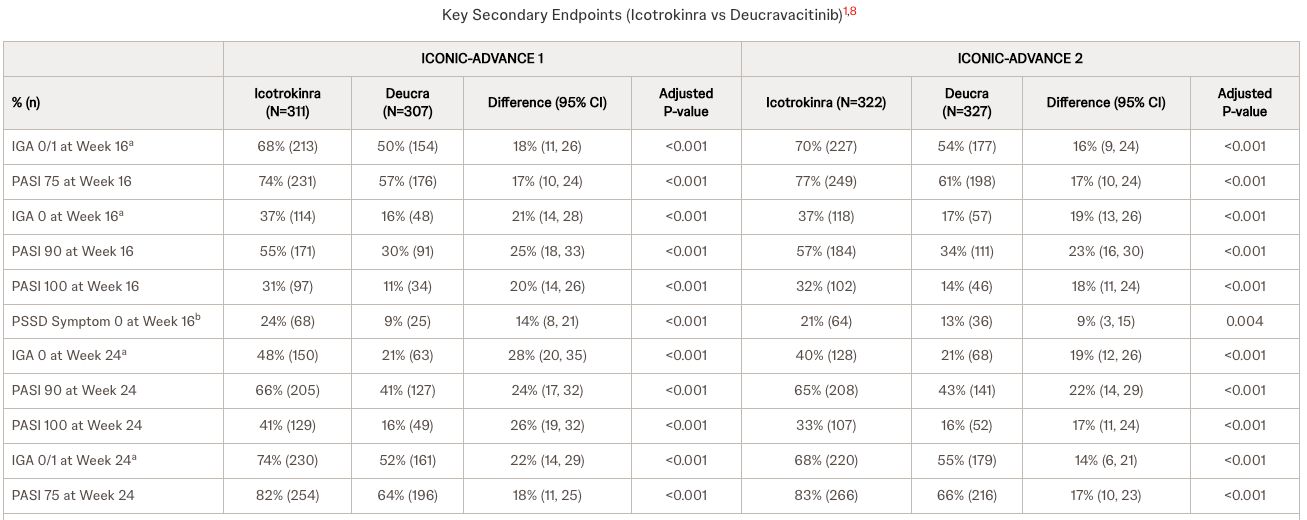

The core issue here is not whether ESK-001 works, but whether it matters. Alumis is bringing a TYK2 inhibitor to market, aiming to be slightly better than Bristol Myers Squibb’s Sotyktu. But the goalposts have moved. Johnson & Johnson is advancing icotrokinra (JNJ-2113), an oral IL-23 receptor antagonist that recently showed superiority over Sotyktu in head-to-head trials. J&J offers biologic-level efficacy in a pill, targeting the same mechanism as the heavy-hitter injectables like Tremfya. In my view, investing in a "me-too" or "slightly better" TYK2 inhibitor when a superior oral mechanism (JNJ's IL-23) is on the horizon is a fundamental error in evaluating commercial viability. Crucially, investors should note that J&J has already filed for approval and is awaiting FDA and EMA decisions later this year, meaning this competitive threat is imminent, not hypothetical.

Let’s be clear about the risk: Shorting a biotech before a data readout is high-wire act. If Alumis reports safety and efficacy data that somehow rivals the injectables or shows a pristine safety profile unlike anything seen in the class, my overnight short will be underwater fast. The market can remain irrational longer than shorts can remain solvent, and a "clean" win for Alumis will bring in buyers regardless of the long-term competitive threat. I am accepting this risk because the probability of them beating the "best-in-class" potential of JNJ is statistically low.

Ultimately, successful biotech investing is about identifying differentiation, not just efficacy. At Biostockinfo, we prefer to back First-in-Class or Best-in-Class candidates—innovations that change the treatment paradigm. Alumis appears to be fighting for second place in a race that is already evolving past them. Whether my overnight trade proves profitable or painful will be decided shortly, but the discipline of evaluating the broader competitive landscape remains the only way to survive in this sector long-term.

*** UPDATE FOLLOWING CONFERENCE CALL ***

The Biotech market is unforgiving, and my overnight short position in Alumis (ALMS) has been, to put it mildly, slaughtered. The company's topline data for envudeucitinib (ESK-001) surprised significantly to the upside, directly challenging the core tenet of my thesis regarding its commercial irrelevance.

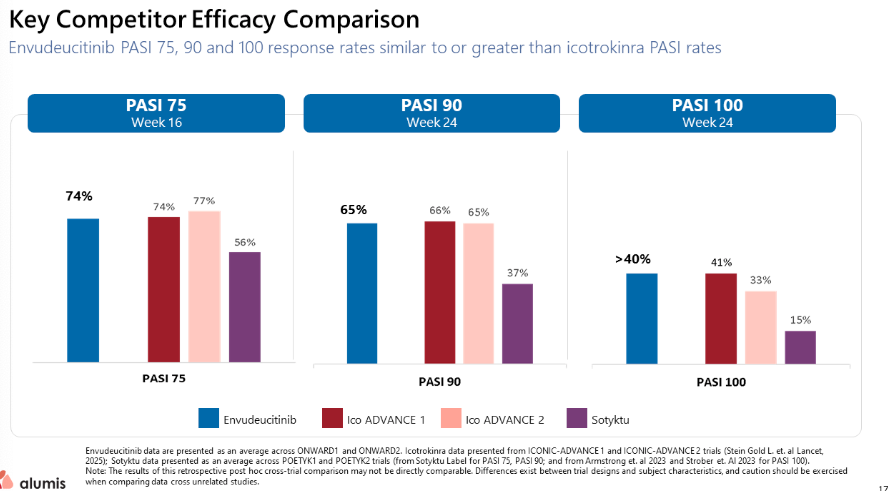

Alumis released a "Key Competitor Efficacy Comparison" that paints a much more bullish picture than I anticipated. The data, presented as a cross-trial comparison, shows envudeucitinib achieving PASI response rates that are "similar to or greater than" Johnson & Johnson's oral IL-23, icotrokinra. Specifically:

- PASI 75 at Week 16: Envudeucitinib demonstrated a 74% response rate, placing it squarely between the 74% and 77% seen in J&J's Ico ADVANCE trials, and well ahead of Sotyktu's 56%.

- PASI 90 at Week 24: Alumis reported a 65% rate, comparable to J&J's 66% and 65%, and significantly superior to the 37% seen with Sotyktu.

- PASI 100 at Week 24: Envudeucitinib showed a >40% response rate, competitive with J&J's 41% and 33%, and dwarfing Sotyktu's 15%.

My argument rested on the idea that J&J's oral IL-23 mechanism would completely overshadow Alumis's TYK2. This data challenges that view by showing efficacy on par with J&J's numbers in this specific cross-trial snapshot.

However, the analyst in me must still offer a note of caution. The provided data comes with a significant disclaimer: it is a "retrospective post hoc cross-trial comparison" and "may not be directly comparable" due to differing trial designs. Furthermore, critical details were missing from the readout, particularly concerning the full safety profile.

While I am not prepared to declare Alumis a definitive competitor for "best-in-class" against J&J based on this limited disclosure, the landscape has undeniably shifted. To put it mildly, the data suggests psoriasis patients will soon have more oral treatment options that are significantly better than currently approved products like Sotyktu. The headline numbers were a clear win for Alumis, triggering a massive spike that crushed my short thesis. The battle in the oral psoriasis space is now far more interesting, and far from over.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.