IN8bio ($INAB) Update: The Cash Crisis Is Over. Now the Real Question Begins.

Three months ago, we called INAB a "tier-one scientific innovator trapped in a tier-four financial vehicle." Since then, the company has raised $20 million, appointed a new President, and quietly unveiled what may be its most valuable asset. Here's what's changed — and what hasn't.

Ticker: INAB (NASDAQ)

Previous Coverage: IN8bio ($INAB): Undervalued Oncology Play or Capital Crunch Disaster? — November 20, 2025

Stock Price at Last Article: ~$1.60

Current Stock Price: ~$1.72 (February 17, 2026)

Market Cap: ~$16.8M

Cash Runway: Extended to 2Q 2027

Analyst Consensus: Buy (2 analysts; Mizuho PT $4.00)

What We Said Then — And What Actually Happened

In our November deep dive, we laid out the central tension: a company with extraordinary clinical data in both AML and glioblastoma, on the verge of running out of money. We wrote:

"Watch for: a partnership or licensing announcement around the paused GBM program. That's the match that could light the fuse."

We also flagged the "make or break" window of 6–9 months, and warned that without a deal or financing, shareholders faced "massive dilution, program shutdowns, or insolvency."

Exactly 29 days after that article published, IN8bio announced the deal that saved the company.

On December 19, 2025, IN8bio priced a structured private placement of up to $40.2 million — far more than most observers expected a company at this market cap could raise. The first close brought in $20.1 million immediately. A second close of up to $20.1 million is tied to development milestones for a program we barely mentioned in our original coverage.

That program is INB-619 — and it may be the most important thing happening at this company right now.

The Financing: Anatomy of a Rescue

Let's break down what actually happened with the December raise, because the structure tells you a lot about what the investors are betting on.

First Close (Completed):

- $20.1 million in gross proceeds

- 5.13 million shares issued at $1.38 per share

- Cash runway extended from mid-2026 to 2Q 2027

Second Close (Milestone-Driven):

- Up to $20.1 million additional

- Triggered by INB-619 (gamma-delta TCE) development milestones

- Up to ~$8.9M in additional capital available through various mechanisms

This is not a standard "panic dilution" financing. The milestone-linked second tranche is specifically tied to the company's T cell engager program for autoimmune disease. In other words, the investors who wrote the check are betting that INB-619's preclinical data will translate into clinical-stage value.

Updated Financial Position:

| Metric | November 2025 | February 2026 |

|---|---|---|

| Cash | ~$10.7M (Q3) | ~$25M+ (estimated) |

| Runway | Mid-2026 | 2Q 2027 |

| Shares Outstanding | ~4.5M | ~9.8M |

| Debt | Zero | Zero |

| Enterprise Value | Negative | Still Negative |

Yes, dilution was significant — shares roughly doubled. But the alternative was corporate death. And even after the dilution, the enterprise value remains negative. The market is still pricing the clinical pipeline at zero or less.

The New Wildcard: INB-619 and the Autoimmune Gold Rush

In our November article, we mentioned INB-619 in a single paragraph under "Upcoming Catalysts." We noted it had shown "deep B-cell depletion in Lupus samples with a cleaner cytokine profile than traditional CD3-based engagers." That was the extent of our coverage.

That was a mistake. After reviewing IN8bio's January 2026 corporate presentation in detail, INB-619 deserves a full section — because the competitive dynamics around this asset have shifted dramatically.

Why B Cell Depletion Is the Hottest Trade in Biotech

If you've been paying any attention to biotech over the past year, you've watched the CD19 CAR-T autoimmune story unfold in real time. Starting with Georg Schett's landmark case series at Universität Erlangen — where patients with severe lupus, systemic sclerosis, and inflammatory myopathy achieved deep, drug-free remissions after CD19 CAR-T therapy — the entire industry has pivoted toward B cell depletion as a potential paradigm shift for autoimmune disease.

The problem with CAR-T for autoimmune disease is the same problem CAR-T has always had: it's expensive ($300K+), requires leukapheresis and weeks of manufacturing, needs lymphodepleting chemotherapy, and carries real risk of CRS and neurotoxicity. For cancer patients with no other options, that's acceptable. For a 35-year-old lupus patient who needs chronic disease management, it's overkill.

The industry's answer: T cell engagers (TCEs) — off-the-shelf bispecific antibodies that redirect the patient's own T cells to destroy CD19+ B cells. No cell manufacturing. No lymphodepletion. Potentially subcutaneous injection in an outpatient setting. This is what everyone is racing toward.

Companies developing CD19-targeting TCEs for autoimmune include Xencor (XmAb657), Kali Therapeutics (KT502), and others, alongside the already-approved oncology TCEs being repurposed (blinatumomab, mosunetuzumab). Regeneron, Roche, and other large pharma players are circling.

The Problem Every CD19 TCE Shares — And Why INB-619 Is Different

Here's the critical issue. Every TCE currently in development or on the market engages conventional alpha-beta (αβ) T cells via CD3. When you activate αβ T cells en masse, they dump inflammatory cytokines — particularly IL-6, IL-10, and IL-17. This is what causes cytokine release syndrome (CRS), the same side effect that has black-box warnings on blinatumomab, mosunetuzumab, glofitamab, and epcoritamab.

In oncology, CRS is manageable with tocilizumab and step-up dosing. In autoimmune disease, where you're treating patients who are already systemically inflamed and may need repeated dosing cycles, CRS is a much bigger obstacle. It limits who can receive the therapy, where it can be administered, and how often it can be given.

INB-619 takes a fundamentally different approach. Instead of engaging αβ T cells through CD3, it redirects gamma-delta T cells to kill CD19+ B cells. This is the first "pan-γδ TCE" — meaning it activates both Vδ1+ and Vδ2+ gamma-delta T cell subtypes.

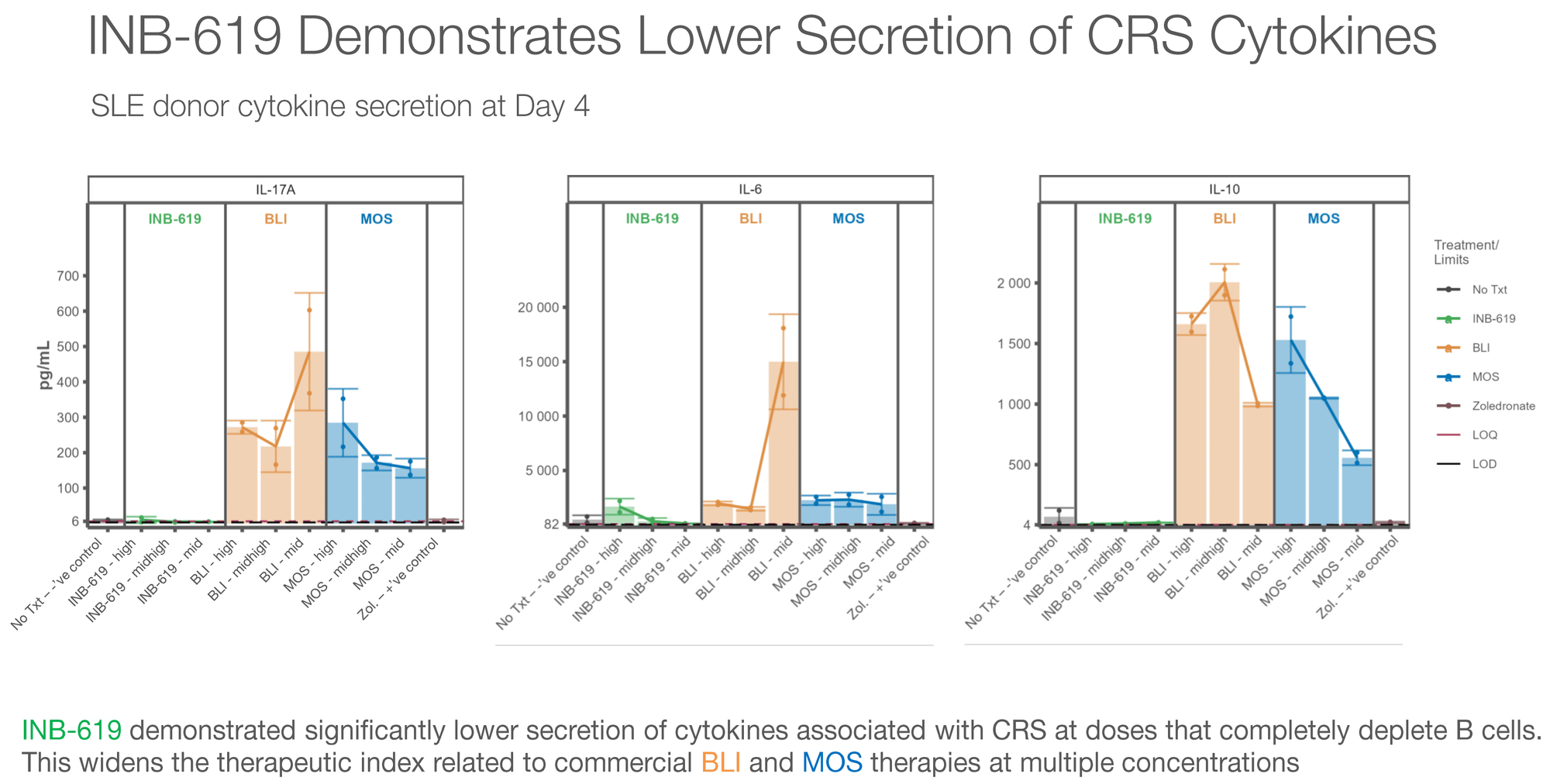

The Preclinical Data (From the January 2026 Presentation)

IN8bio ran head-to-head in vitro comparisons of INB-619 against two commercial TCEs:

- Blinatumomab (BLI): FDA-approved CD19×CD3 TCE (Amgen)

- Mosunetuzumab (MOS): FDA-approved CD20×CD3 TCE (Roche/Genentech)

B Cell Killing: INB-619 achieved complete B cell depletion (tested against NALM-6 cells) at equivalent or superior levels compared to both blinatumomab and mosunetuzumab across multiple concentrations. The EC50 values clustered tightly across different donors, even when starting γδ T cell levels varied from 0.2% to 5% — suggesting consistent activity regardless of patient variability.

Cytokine Profile — This Is the Key Differentiator: Compared to BLI and MOS, INB-619 produced significantly lower levels of:

- IL-6 (the primary driver of CRS)

- IL-10 (associated with immunosuppression)

- IL-17 (linked to autoimmune pathology)

This cytokine profile is exactly what the field needs. If you can achieve equivalent B cell killing with dramatically lower inflammatory cytokine release, you've potentially solved the safety problem that limits TCE adoption in autoimmune disease.

The Tissue Penetration Argument

There's a deeper biological rationale that most investors are missing.

Conventional αβ TCEs primarily engage circulating T cells in the blood and secondary lymphoid organs. But in autoimmune diseases, the pathogenic B cells often reside in tissues — the joints (rheumatoid arthritis), the kidneys (lupus nephritis), the skin (scleroderma), the gut (inflammatory bowel disease).

INB-619 activates Vδ1+ T cells. Unlike Vδ2+ cells (which primarily circulate in blood), Vδ1+ cells are tissue-resident. They live inside the very organs where autoimmune disease causes damage. This means INB-619 could potentially achieve deeper B cell depletion in tissue compartments that conventional TCEs cannot reach.

This is theoretical at this stage, but the biological rationale is sound, and if confirmed in animal models (data expected 2026), it would represent a genuine competitive advantage over every other TCE in development.

INB-619 Status and Timeline

- IND-enabling studies: Underway

- Pivotal animal model data: Expected 2026

- FDA pre-IND discussions: Planned following animal data

- Second financing close: Tied to INB-619 milestones

The Adicet Comparison: Why ACET Validates INAB's Thesis — and Why INB-619 Could Leapfrog It

We can't discuss γδ T cells in autoimmune disease without talking about Adicet Bio ($ACET), because their clinical data is currently the strongest proof that this whole approach works.

In October 2025, Adicet reported Phase 1 data for ADI-001 — an allogeneic (off-the-shelf) γδ CAR-T cell therapy targeting CD20 — in patients with lupus nephritis and systemic lupus erythematosus. The results were striking: all seven evaluable patients showed rapid and sustained disease activity reductions. Among the five lupus nephritis patients, three achieved complete renal responses and DORIS remissions, with two partial responses. There was no ICANS and no Grade 2 or higher CRS. Adicet reported evidence of "immune reset" — the disease-driving B cell clones were wiped out, and new, naïve B cells emerged. Patients were able to discontinue immunosuppressants and taper corticosteroids.

This data earned ADI-001 FDA Fast Track designation for lupus nephritis, SLE, and systemic sclerosis. Adicet is planning a potentially pivotal Phase 2 trial starting Q2 2026, with 25+ clinical sites globally.

Here's why this matters enormously for INAB investors: Adicet's clinical proof-of-concept validates the core biological premise that γδ T cells can achieve meaningful B cell depletion in autoimmune disease with a favorable safety profile. The market is valuing ACET at roughly $40-68 million for this data. INAB trades at $8-17 million — a fraction of that.

But INB-619 and ADI-001 are fundamentally different approaches, and the differences favor INB-619 in several important ways for the autoimmune setting:

| Feature | Adicet ADI-001 | IN8bio INB-619 |

|---|---|---|

| Modality | Allogeneic γδ CAR-T cell | γδ T cell engager (bispecific antibody) |

| Target | CD20 | CD19 |

| Manufacturing | Requires cell manufacturing, cryopreservation, shipping | Off-the-shelf molecule (no cell manufacturing) |

| Lymphodepletion | Requires conditioning chemo (cyclophosphamide ± fludarabine) | None expected |

| Administration | Single infusion, likely inpatient | Potentially subcutaneous, outpatient, repeat-dosable |

| γδ Subtypes Engaged | Primarily Vδ1+ (engineered) | Pan-γδ: both Vδ1+ AND Vδ2+ |

| B Cell Coverage | CD20+ B cells (misses CD20⁻ early lineage B cells and some plasma cells) | CD19+ B cells (broader lineage coverage, including early B cells) |

| Tissue Penetration | Engineered cells infused; trafficking dependent on conditioning | Engages tissue-resident Vδ1+ cells already in target organs |

| Repeat Dosing | Challenging (alloimmunity risk) | Straightforward (antibody, not cells) |

| Stage | Phase 1 (patient data) Phase 2 - Q1 2026 |

Preclinical (IND-enabling) |

| Market Cap | ~$50-68M | ~$15-17M |

Let's unpack the three most important differences:

1. No Lymphodepletion Required. ADI-001, like all CAR-T therapies, requires patients to undergo conditioning chemotherapy before cell infusion. This is manageable in cancer patients, but it's a significant barrier for autoimmune patients — many of whom are young women with lupus who are already immunocompromised. Conditioning chemo carries real risks: infection, cytopenias, fertility concerns. A TCE like INB-619 would bypass this entirely, potentially enabling true outpatient treatment.

2. CD19 vs. CD20 Targeting. This is a subtle but important distinction. CD20 is expressed on mature B cells, but not on early lineage B cells (pre-B cells, pro-B cells) or many long-lived plasma cells. CD19 has broader expression across the B cell lineage. In autoimmune disease, the pathogenic cells may include these CD20-negative populations that escape ADI-001's reach. This is the same rationale behind why CD19 CAR-T (like the Erlangen approach) showed potentially deeper remissions than anti-CD20 antibodies like rituximab — CD19 captures more of the disease-driving lineage.

3. Engaging Tissue-Resident Vδ1+ Cells Already In Place. Here's the subtlest and potentially most important advantage. ADI-001 infuses engineered Vδ1+ cells that then need to traffic to disease sites. INB-619, by contrast, activates the patient's own tissue-resident Vδ1+ T cells — cells that are already living inside the kidneys, joints, skin, and gut where autoimmune disease does its damage. If this translates clinically, INB-619 could achieve deeper B cell depletion in tissue compartments than any infused cell therapy.

The critical caveat: All of this is theoretical for INB-619 at this point. Adicet has patient data. IN8bio has in vitro data and is awaiting animal model results. The clinical gap is real and significant — Adicet is perhaps 18-24 months ahead.

But the strategic read is this: Adicet has de-risked the γδ autoimmune thesis for IN8bio. Every positive Adicet data point makes INB-619 more credible and more valuable. And if INB-619's preclinical advantages — lower cytokine release, pan-γδ engagement, no conditioning — translate into even modestly better clinical outcomes, the market will need to re-price INAB accordingly.

At a minimum, the ACET comparison highlights the valuation absurdity: a preclinical TCE with a differentiated profile in the hottest area of drug development, housed inside a company trading at negative enterprise value.

Updated Clinical Data: The Curves Are Holding

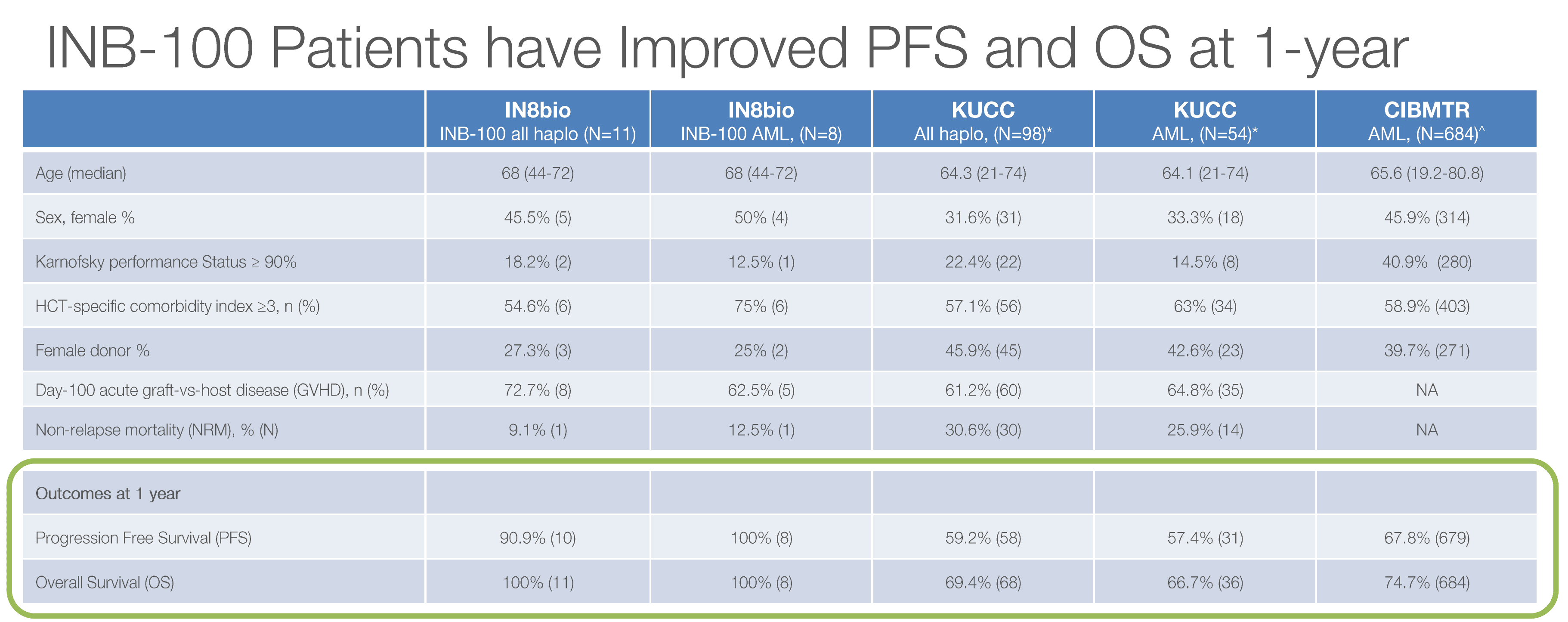

INB-100 (AML) — Still Perfect at 20 Months

Since our November article, the INB-100 data has been updated through December 31, 2025. The headline: nothing has changed, and in this case, that's great news.

| Metric | November 2025 | February 2026 Update |

|---|---|---|

| Complete Remission | 100% | 100% |

| 1-Year PFS | 100% | 90.9% (updated methodology) |

| 1-Year OS | 100% | 100% |

| Median Follow-Up | ~20.1 months | 20.1 months |

| Relapses | Zero | Zero |

| CRS/ICANs | Zero | Zero |

The slight PFS adjustment to 90.9% reflects updated statistical methodology with longer follow-up across the full evaluable cohort, but still dramatically exceeds the 59.2% historical benchmark from KUCC.

At dose level 2, γδ T cell levels expanded 49-fold above the threshold associated with improved clinical outcomes. This dose-response signal adds biological plausibility to what could otherwise be dismissed as small-sample luck.

The trial has now expanded to The Ohio State University — a top-tier transplant center — in addition to the original UAB site and other centers. Multi-center enrollment is active.

INB-200/400 (GBM) — Paused, But the Data Got More Rigorous

The GBM program remains on pause, as we flagged in November. No new patients are being dosed. But the existing patient cohort continues to be followed — and the January 12, 2026 update brought an important evolution in how the data is being presented.

In our November article, we cited the 16.1-month median PFS figure from the ASCO 2025 presentation. That number came from the Phase 1 INB-200 repeat-dose subset compared against the historical Stupp benchmark of 6.9 months — a +133% improvement.

The January 2026 update changed two things. First, IN8bio combined data from both the Phase 1 (INB-200) and Phase 2 (INB-400) trials into a single repeat-dose cohort (N=14). Second — and this is significant — for the first time, the company presented a contemporaneous control group: patients enrolled at the same clinical centers and treated by the same physicians using SOC only.

Here's what the updated combined analysis shows:

| Metric | DeltEx DRI Repeat Dose (N=14) |

SOC Control |

|---|---|---|

| Median PFS | 13.0 months | 6.6 months |

| PFS Improvement | +97% | — |

| Median OS | 17.2+ months (not yet reached) |

13.2 months |

| OS Improvement | +30.3%+ | — |

| PFS > Expected OS | 57% of patients | — |

Is 13.0 months less dramatic than 16.1 months? Yes. But this is actually a stronger dataset for three reasons:

- Contemporaneous controls are more rigorous than historical comparisons. The SOC control patients came in at 6.6 months — right in line with the historical 6.9-month benchmark, even though a higher proportion of control patients received gross total resections (which should bias outcomes in their favor). This validates both the severity of the disease and the magnitude of the DeltEx benefit.

- The combined cohort is more representative. Pooling Phase 1 and Phase 2 patients across multiple centers (UAB, Cleveland Clinic, Moffitt, Ohio State) gives a broader picture than single-site Phase 1 data.

- Nearly doubling PFS (+97%) with a contemporaneous control is arguably more publishable and partnership-worthy than a +133% improvement against historical benchmarks, which always carry selection bias risk.

The median OS still hasn't been reached at 17.2+ months, which continues to exceed the 13.2-month SOC control by over 30%. And 57% of treated patients have remained progression-free longer than they would have been expected to survive — a striking statistic in GBM.

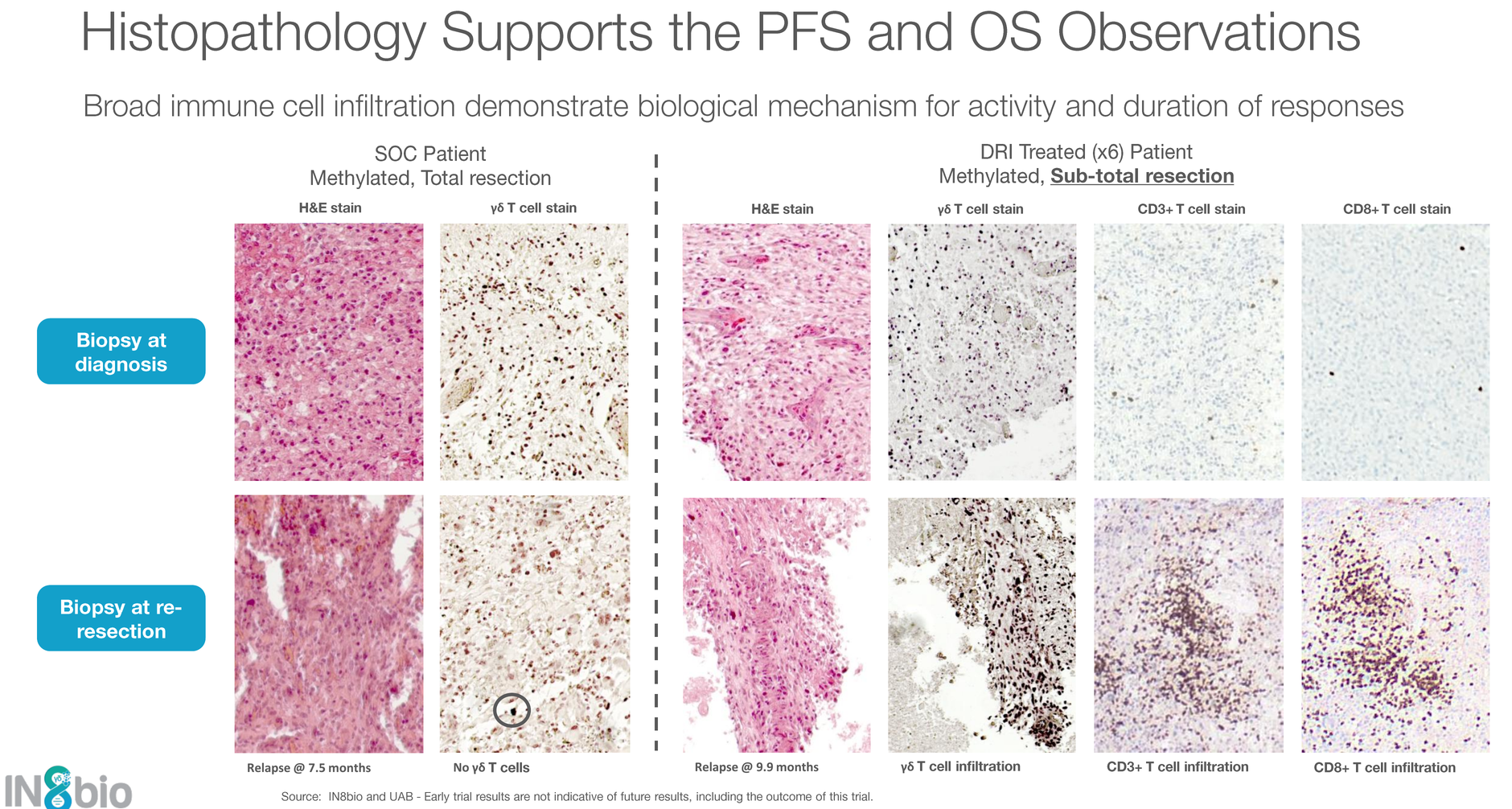

Perhaps the most compelling new data point is the histopathology from treated patients. Tumor tissue biopsies show broad immune infiltration — not just the infused γδ T cells, but CD3+ and CD8+ conventional T cells as well. This suggests IN8bio's γδ T cells are not just killing tumor cells directly; they're converting "cold" tumors into "hot" ones by recruiting the broader adaptive immune system.

This has always been the holy grail in GBM immunotherapy, and very few approaches have demonstrated this kind of immune conversion in tissue.

The GBM program remains the most likely partnership catalyst. A "shovel-ready" Phase 2 program with contemporaneous control data showing nearly doubled PFS, in the largest unmet need in neuro-oncology, is the type of asset that attracts pharma interest — especially when the acquiring company can negotiate from a position of strength given INAB's small size.

Management Update: A Notable Addition

On February 9, 2026, IN8bio announced the appointment of Dr. Kate Rochlin as President. Rochlin holds a PhD and brings operational and strategic experience to complement CEO William Ho's financial background and CSO Lawrence Lamb's scientific leadership.

This is a meaningful signal. Distressed biotechs that are winding down don't hire new Presidents. This appointment suggests the company is professionalizing its management structure in preparation for either partnership negotiations, a clinical milestone (INB-619 IND), or both.

The current leadership structure:

- William Ho — CEO & Co-Founder (strategy, capital markets)

- Dr. Kate Rochlin — President & COO (operations)

- Dr. Lawrence Lamb — Co-Founder & CSO (30+ years γδ T cell expertise)

- Patrick McCall, CPA — CFO & Secretary

Sector Context: The Takeda Wreckage and What It Means

We need to address the elephant that walked into the room right around our last article.

On October 1, 2025, Takeda — the single largest corporate investor in gamma-delta T cell therapy — announced it was exiting the space entirely, taking a $395 million impairment charge primarily tied to its γδ T cell platform. Takeda had acquired both GammaDelta Therapeutics (2021) and Adaptate Biotherapeutics (2022), spending an estimated $400M+ to build the sector's most well-funded γδ T cell effort.

Then they walked away. No active clinical trials. No partner identified. Just a massive write-down.

This was devastating for sector sentiment. It reinforced the narrative that γδ T cells are an unproven modality, and it happened just as IN8bio was trying to raise survival capital. You can argue that Takeda's exit directly contributed to INAB's depressed valuation and difficult fundraising environment.

But the critical distinction that the market refuses to make is this: Takeda had no clinical data. IN8bio does.

Takeda's γδ programs were largely preclinical. Their lead asset (GDX012, an allogeneic Vδ1 T cell therapy for AML) was in a Phase 1/2 trial that produced no reported efficacy data before being shelved. Takeda's decision to exit reflects a strategic portfolio prioritization — they're pivoting to small molecules, biologics, and ADCs — not a scientific invalidation of γδ T cell biology.

IN8bio has clinical data showing 100% remission in AML at 20 months and nearly doubled PFS in GBM versus contemporaneous controls. These are not preclinical hypotheses. These are patient outcomes.

One could argue Takeda's exit actually helps IN8bio by removing a well-resourced competitor from the space, while the clinical data becomes the sector's defining proof point.

Updated Risk Assessment

Our November risk factors remain largely intact, but some have shifted:

| Risk Factor | November 2025 | February 2026 Status |

|---|---|---|

| Cash runway | Critical (mid-2026) | Resolved (2Q 2027) |

| Dilution | Anticipated | Occurred (~2x share count) |

| Warrant overhang | Present | Increased (financing warrants) |

| Partnership dependence | High | High (unchanged) |

| Sector sentiment | Negative | Still negative (post-Takeda) |

| Small sample sizes | 16 AML / 14 GBM | Same cohorts, longer follow-up |

| Institutional support | None | None (per TipRanks) |

| Liquidity | Very thin | Very thin (~285K avg daily volume) |

New risks since November:

- Share registration overhang: In January 2026, IN8bio filed to register 14.38 million shares for existing holders — creating significant potential selling pressure

- Reverse split decay: Post-reverse-split stocks carry a persistent negative sentiment stigma with retail investors

- INB-619 execution risk: The entire second financing tranche depends on INB-619 milestones. If animal data disappoints, the second $20.1M may never close

Updated Catalyst Calendar

Cash position update; operational guidance

⭐ Highest-impact catalyst — validates platform

Determines IND path + triggers second close

Strengthens regulatory package for Phase 2

Durability signal for partnership value

Peer review visibility

Revised Valuation Framework

The investment case has evolved since November. The cash crisis is resolved, but dilution has roughly doubled the share count. Here's how the scenarios look now:

Bear Case: $0.80–$1.50 (-55% to -13%)

- No partnership in 2026

- INB-619 animal data fails to meet milestone thresholds

- Second tranche never closes; additional dilutive raise needed EOY

- Sector sentiment doesn't recover

- Probability: 35%

Base Case: $3.00–$5.00 (+74% to +191%)

- GBM partnership signed (non-exclusive license, modest upfront + milestones)

- INB-619 animal data supports IND filing; second tranche closes

- INB-100 data continues to hold at multi-center expansion

- Probability: 40%

Bull Case: $6.00–$12.00+ (+249% to +598%)

- Major pharma partnership or acquisition offer

- INB-619 demonstrates best-in-class preclinical profile, enters clinical development

- GBM long-term survival data shows continued benefit beyond 2 years

- γδ sector sentiment recovers as Takeda assets potentially find a new home

- Probability: 15%

Terminal Risk: $0.00

- Clinical setback in INB-100 (first relapse would break the thesis)

- Cash runs out without any deal

- Probability: 10%

Note: Mizuho maintains an Outperform rating with a $4.00 price target (reduced from $6.00 in January 2026). HC Wainwright also covers the stock.

The Bottom Line: What's Changed, and What Matters Now

Three months ago, the question was existential: Can this company survive?

That question is answered. The December financing buys 18 months of runway. The company is alive.

The new question is more interesting: Can this company prove that gamma-delta T cells belong in the same conversation as CAR-T, TCEs, and the broader immunotherapy revolution?

Here's what I'm watching most closely:

1. INB-619 animal data (2026). This is now the fulcrum of the entire investment case. If the preclinical cytokine advantage translates to animal models — equivalent B cell depletion with meaningfully lower CRS — this asset could single-handedly justify the current market cap many times over. The autoimmune TCE space is attracting billion-dollar valuations for preclinical programs. IN8bio doesn't need a billion-dollar valuation. It needs a $50M one to be a 3x from here.

2. GBM partnership. The program is shovel-ready with genuinely differentiated data. The question isn't whether the data is impressive — it is — but whether any pharma company is willing to license a γδ T cell asset in the current sentiment environment. Takeda's exit makes this harder, not easier.

3. INB-100 durability. Zero relapses at 20+ months is extraordinary. Every additional month that holds adds to the regulatory narrative. But the first relapse, whenever it comes, will test investor resolve.

At $1.72, with negative enterprise value, the market is pricing in failure across all three dimensions. If even one of these catalysts breaks in the company's favor, the risk/reward from current levels is heavily asymmetric.

The data remains too good to ignore. The capital structure, while imperfect, is no longer terminal. And with INB-619, there's a new angle the market hasn't begun to price in.

The "Lazarus play" is alive. Now we see if it can walk — and it will be a long, tough road.