Why a French Biotech Nobody's Heard Of Could Deliver 5x Returns in 2026

First and only to hit both FDA surrogate endpoints in Phase 2b. Fully enrolled Phase 3, topline H2 2026. Most advanced oral MASH program outside approved Rezdiffra. Yet trading at $650M—1/6th~1/15th of comparable competitors.

When Data Meets Indifference: A Pattern We've Seen Before

In July 2025, Abivax surged ~5x on positive Phase 3 UC data—after 18 months of investor apathy despite solid Phase 2b evidence. Biotech often misprices differentiation until late. Inventiva (NASDAQ: $IVA) may be the next example: an oral MASH agent that hit both FDA surrogate endpoints in Phase 2b, now fully enrolled in Phase 3 and funded through readout.

The pattern repeats across biotech. A company with genuine clinical differentiation trades in obscurity—often small-cap, often European, often invisible to US institutions. The data sits in top journals. Partnerships validate the science. Yet the stock trades as if running an early-stage trial in a crowded indication.

Until suddenly, it doesn't.

Today, I'll make the case that with, Inventiva S.A., another French biotech with compelling data. The evidence: a drug that achieved something genuinely rare in MASH—hitting both primary surrogate endpoints in Phase 2b, the first and only to do so—now fully enrolled in Phase 3, capitalized through readout, with commercial-grade management assembled for launch.

Current market cap: $650 million.

Comparable oral MASH assets: acquired for $3.5-5.2 billion pre-approval.

Almost no one in the US market is paying attention.

The Information Asymmetry

Spend five minutes on biotech Twitter or Reddit discussing MASH, and you'll notice something: Viking Therapeutics (VKTX) and Altimmune (ALT) dominate the retail conversation. Both US-based, both with active retail communities, both with liquid options chains attracting momentum traders, though admittedly Viking 's main focus is around the obesity.

When you ask about Inventiva (IVA) or Zealand Pharma (ZEAL)? Blank stares.

Yet consider the clinical profiles:

- Inventiva: Only drug to hit both FDA surrogate endpoints (MASH resolution AND fibrosis improvement) in Phase 2b; fully enrolled Phase 3; €348M raised from NEA, BVF Partners, Samsara BioCapital—the largest financing in French biotech history

- Zealand: Survodutide showing 83% MASH resolution in Phase 2b, backed by Boehringer Ingelheim partnership worth up to €4.7B

Three structural barriers create this geographic arbitrage:

- Exchange friction: Primary Euronext Paris listing creates psychological barriers for US retail who prefer pure NASDAQ tickers with familiar trading hours, despite being listed on NASDAQ via ADR.

- Media asymmetry: US biotech media ecosystems—Seeking Alpha, FinTwit, YouTube channels—skew overwhelmingly toward US companies. When VKTX announces data, it trends. When IVA announces data, it barely registers.

- AI amplification: Ask ChatGPT, Gemini, or Grok about "promising MASH candidates" and you'll consistently get Madrigal, Novo Nordisk, Viking, Altimmune. European companies with Euronext primary listings simply don't generate the English-language content volume that trains these models.

The result: systematic information asymmetry. Not insider trading. Not hidden data. Just pure geographic arbitrage amplified by predictable attention patterns.

Sophisticated money sees it differently. Three top-tier VCs didn't commit €348M to Inventiva because they were following Reddit threads. They see superior clinical data, clear regulatory precedent, and valuations untouched by retail speculation.

Many US based MASH trains have left the station.

IVA? Still waiting at the platform for US Market to notice its existence!

The MASH Opportunity: A Market Segmenting by Patient Phenotype

MASH (Metabolic dysfunction-Associated Steatohepatitis) affects 3-5% of the global population—over 200 million people worldwide. In the US alone, approximately 9 million have F2-F3 fibrosis, the target population for drug intervention.

The addressable market: $31-96 billion by 2032-2035.

The FDA validated this indication definitively in 2024-2025:

- March 2024: Madrigal's Rezdiffra (resmetirom) approved for F2-F3 MASH

- August 2025: Novo Nordisk's Wegovy (semaglutide) approved for MASH with fibrosis

The market exists. The regulatory pathway is established. Payers are building reimbursement frameworks.

But MASH is not a monolithic disease—and the market won't be winner-take-all.

Imagine a 55-year-old with MASH, type 2 diabetes, obesity, and F2-F3 liver fibrosis. This patient faces two interconnected problems:

- Metabolic dysfunction: Insulin resistance, hyperglycemia, dyslipidemia—the systemic forces actively driving liver disease

- Liver fibrosis: Progressive scarring that, if unchecked, leads to cirrhosis, liver failure, and death

Cardiovascular disease—not liver failure—is the #1 cause of mortality in this population. The liver disease exists within a constellation of metabolic comorbidities.

This creates distinct patient phenotypes requiring different therapeutic approaches:

Metabolic-Dominant MASH: Patients where obesity and diabetes are actively fueling liver disease. These patients need systemic metabolic correction first and foremost.

Fibrosis-Dominant MASH: Patients with advanced F3 or compensated cirrhosis (F4), where fibrotic scarring has become self-perpetuating. These patients need direct anti-fibrotic intervention.

Moderate MASH with Metabolic Syndrome: The vast middle F2-F3 patients with type 2 diabetes who need BOTH liver-directed efficacy AND metabolic benefits, delivered orally for long-term adherence.

The market is segmenting to serve these distinct needs.

The Competitive Landscape: Complementary, Not Zero-Sum

Four therapeutic pillars are emerging for MASH, each with a clear value proposition:

1. THR-β Agonists (Madrigal, Viking, Aligos)

Mechanism: Liver-directed thyroid hormone receptor-beta agonist that enhances fatty acid oxidation and reduces lipotoxicity.

Strengths:

- First-mover advantage as only FDA-approved MASH therapy

- Oral, once-daily administration

- Demonstrated dual efficacy on MASH resolution (30% vs 10% placebo) and fibrosis improvement (26% vs 14% placebo)

- Robust LDL-cholesterol reduction (~15-20%)

Limitations:

- Modest absolute efficacy (10-16% placebo-adjusted benefit)

- No glycemic benefit in diabetic patients

- FDA label warnings for hepatotoxicity and gallbladder events

- Drug-drug interactions with statins

Best for: F2-F3 MASH patients without severe metabolic comorbidities seeking oral, liver-focused therapy.

2. GLP-1 Receptor Agonists (Novo, Lilly, Zealand)

Mechanism: Systemic metabolic regulation through enhanced insulin secretion, appetite suppression, and profound weight loss.

Strengths:

- Unmatched MASH resolution rates (63% semaglutide, 73% tirzepatide vs 13-34% placebo)

- Treats multiple diseases simultaneously (obesity, T2D, cardiovascular risk)

- Massive commercial infrastructure through primary care and endocrinology

- Proven cardiovascular benefits

Limitations:

- Injectable administration (barrier for some patients)

- High GI side effect burden (30-50% real-world discontinuation)

- Weight regain upon cessation

- Less direct anti-fibrotic activity—benefits largely mediated by weight loss

- Expensive

Best for: MASH patients with comorbid obesity and/or T2D requiring systemic metabolic transformation. Will likely become the dominant therapy for metabolic-driven disease.

3. FGF21 Analogues (Akero , 89bio)

Mechanism: Direct anti-fibrotic action through inhibition of hepatic stellate cell activation, plus metabolic benefits.

Strengths:

- Potent, direct anti-fibrotic effects (49-75% fibrosis improvement at 96 weeks)

- Landmark achievement: efruxifermin showed 39% cirrhosis reversal (F4→F3) in Phase 2b SYMMETRY trial—first therapy to demonstrate this

- Effective in advanced disease where metabolic correction alone may be insufficient

- Demonstrated benefit on top of GLP-1s (combination potential)

Limitations:

- Injectable administration

- GI side effects (nausea, diarrhea)

- Less profound systemic metabolic effects than GLP-1s

- Higher cost expected

Best for: Advanced fibrosis (F3) and compensated cirrhosis (F4) patients where halting/reversing scarring is the paramount goal. The hepatologist-prescribed specialist therapy.

4. Pan-PPAR Agonists (Lanifibranor - Inventiva)

Mechanism: Balanced activation of PPARα, PPARδ, and PPARγ—simultaneously enhancing fatty acid oxidation (α/δ), improving insulin sensitivity (γ), and reducing inflammation (all three).

The Unmet Need This Addresses:

Look at the landscape from a patient and prescriber perspective:

- Rezdiffra: Oral and liver-focused, but offers no glycemic benefit for the 55% of MASH patients with diabetes. Modest efficacy. Safety warnings.

- GLP-1s: Phenomenal metabolic benefits, but injectable, and 30-50% of patients discontinue due to GI side effects or intolerance.

- FGF21s: Powerful anti-fibrotic agents for advanced disease, but injectable, expensive, and positioned for specialized hepatology use.

What's missing? An oral therapy optimized for the massive F2-F3 MASH + Type 2 Diabetes population (~15 million in US alone), delivering robust efficacy on BOTH liver endpoints AND comprehensive metabolic benefits.

This is lanifibranor's positioning—not competing directly with GLP-1s for the metabolic-dominant phenotype, but serving patients who:

- Cannot or will not tolerate injectable therapies

- Need oral convenience for long-term chronic disease management

- Require simultaneous liver AND glycemic benefits

- Want the option to combine with SGLT2 inhibitors or low-dose GLP-1s

These are complementary therapeutic approaches, not zero-sum competition. The patient who needs a potent injectable for metabolic transformation is different from the patient seeking an oral backbone therapy for chronic management with metabolic comorbidities.

Lanifibranor: The Clinical Differentiation Story

NATIVE Phase 2b: The Breakthrough Data

Published in the New England Journal of Medicine (October 2021), the NATIVE trial evaluated 247 patients with biopsy-proven MASH and F2-F3 fibrosis over 24 weeks. 42% had type 2 diabetes.

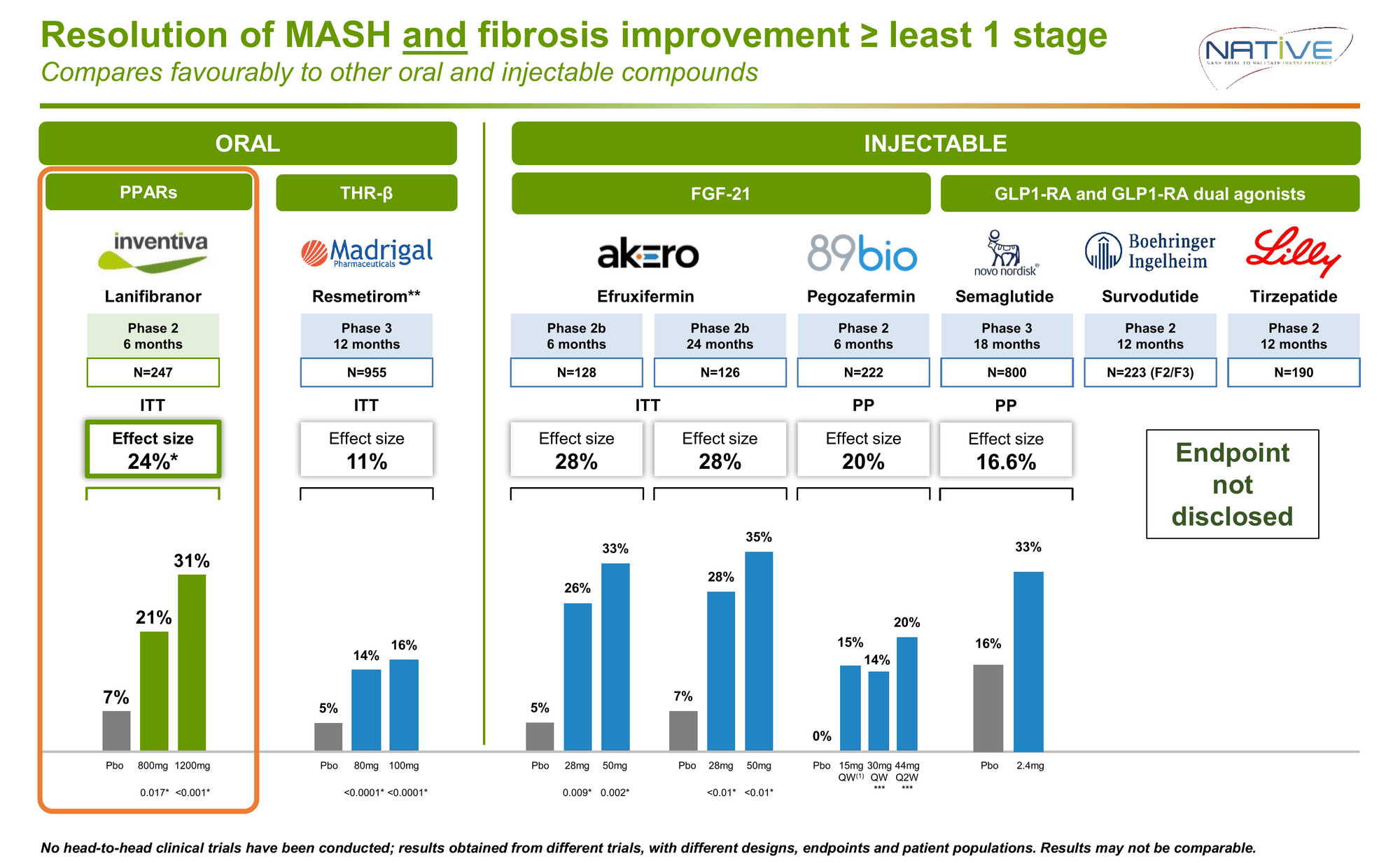

This was the first and only MASH candidate to achieve statistical significance on both FDA surrogate endpoints required for accelerated approval in a single trial.

For context: Rezdiffra's pivotal Phase 3 showed 16% on the composite endpoint (11% placebo-adjusted) after 52 weeks. Lanifibranor delivered more than double the effect in half the time.

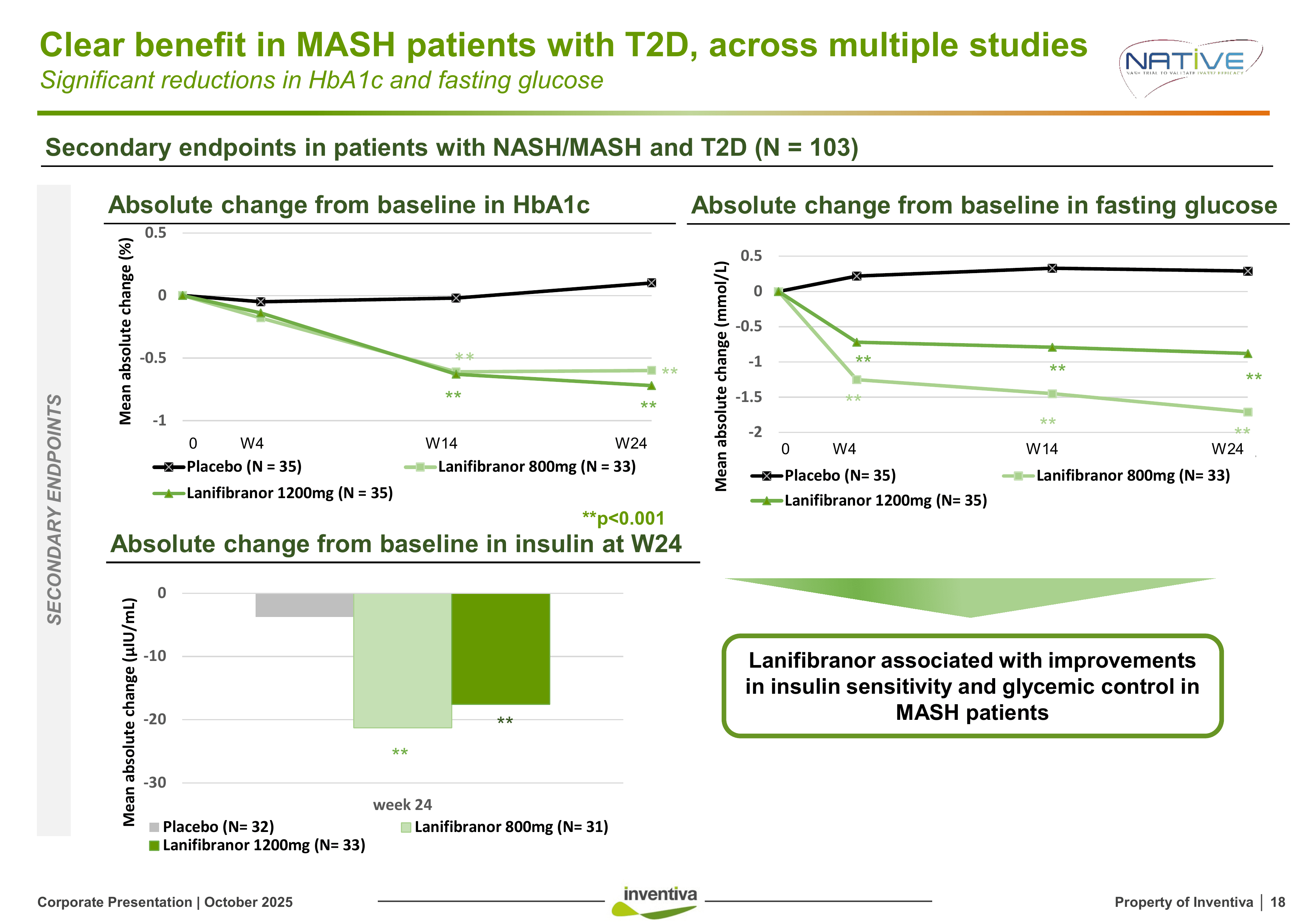

The Hidden Differentiator: Comprehensive Metabolic Transformation

55% of MASH patients have type 2 diabetes. Cardiovascular disease—not liver failure—is the leading cause of death in this population.

Lanifibranor's metabolic effects in diabetic patients (n=103, 24 weeks):

Rezdiffra provides none of these glycemic benefits.

Critically: The composite endpoint effect size was higher in T2D patients (26% vs 22%). This isn't just subgroup noise, it's a signal that lanifibranor's multi-pathway mechanism is particularly effective in the metabolic syndrome phenotype.

Addressing the Elephant in the Room: Weight Gain

PPAR agonists historically caused problematic weight gain. Pioglitazone induced ~5kg over 96 weeks with continuous progression.

Lanifibranor showed mean weight gain of 2.4-2.7kg at 24 weeks. But the picture is more nuanced:

- Only 49% of patients gained weight (>2.5% increase)

- 51% maintained stable weight or lost weight

- Weight gain plateaued at 24-36 weeks (didn't continuously increase)

- Patients who gained weight showed equivalent improvements in all metabolic and liver markers

The Solution: LEGEND Phase 2a Trial (March 2024)

Inventiva ran a proof-of-concept trial combining lanifibranor with empagliflozin (Jardiance), an SGLT2 inhibitor commonly prescribed for diabetes.

Results at 24 weeks:

| Metabolic Parameter | Lanifibranor Monotherapy |

Lanifibranor + Empagliflozin |

|---|---|---|

| HbA1c Reduction Diabetes control | -1.5% | -1.5% ✓ |

| Liver Fat Reduction Primary MASH target | -49% | -41% ✓ |

| Inflammation (cT1) Liver inflammation marker | -86 ms | -75 ms ✓ |

| Weight Change Key differentiator | +2.7 kg | +0.6 kg ✓ |

The combination completely neutralized weight gain while maintaining full efficacy on all liver and metabolic endpoints.

This proves two critical points:

- Lanifibranor can be the oral backbone of combination regimens with SGLT2is or GLP-1s

- The weight concern, while real, has a validated pharmaceutical solution

For the target population (MASH + T2D), many patients are already on or candidates for SGLT2 inhibitors. The risk/benefit calculus is entirely different when you're delivering -0.7% HbA1c, +18-26% fibrosis improvement, and 45% MASH resolution.

Safety: Breaking the PPAR Curse

NATIVE safety profile (247 patients, 24 weeks):

- Serious adverse events: 6.0% vs 3.7% placebo

- Discontinuation due to AE: 3.6% vs 3.7% placebo

- Peripheral edema: 7-8% (mostly mild, self-limited)

No signals of: skeletal muscle toxicity, renal dysfunction, bladder proliferative changes, cardiac hypertrophy, or significant bone density issues, the class-effect toxicities that plagued earlier PPAR agonists.

The FDA reviewed the complete non-clinical toxicology package and deemed it acceptable for NDA filing—meaning no preclinical red flags prevent approval if Phase 3 succeeds.

NATiV3 Phase 3: Fully Enrolled, Data H2 2026

Trial Design:

- 1,009 patients in main cohort (F2-F3 fibrosis) — over-enrolled from 969 target

- 410 patients in exploratory cohort (F1-F4)

- Randomized 1:1:1: placebo, 800mg, 1200mg

- Duration: 72 weeks

- Primary endpoint: Composite of MASH resolution AND ≥1 stage fibrosis improvement

- Statistical power: 90%

- Expected topline data: H2 2026

Patient Population (Main Cohort):

- 55% have Type 2 diabetes (vs 42% in Phase 2b)—enriched for the population showing strongest efficacy

- F2 fibrosis: 30% / F3 fibrosis: 69%

- Mean BMI: 35.3 kg/m²

- 13% on GLP-1s at baseline / 10% on SGLT2is at baseline

Blinded Interim Analysis:

Inventiva reported that "baseline values and magnitude of changes in relevant biomarkers are consistent" between Phase 2b and Phase 3.

This is the strongest possible signal from blinded data that the Phase 3 population is responding similarly to Phase 2b, without breaking the blind, the company can confirm the trial dynamics look right.

The Advancement Advantage:

While competitors discuss Phase 2 plans or early Phase 3 enrollment:

- Lanifibranor: Fully enrolled, 72-week treatment ongoing, data readout H2 2026

- Viking VK2809: Phase 2b data to be released, Phase 3 not yet initiated

- Altimmune pemvidutide: Phase 2b complete

- Zealand survodutide: Phase 3 initiated but early enrollment

- Terns TERN-501: Phase 2 stage

- Akero Efruxifermin : Phase 2b complete

- 89bio Pegozafermin : Phase 3 Topline for F2/F3 H1 2027

Inventiva is the most advanced oral MASH program in late-stage development outside of approved Rezdiffra.

Strategic De-Risking: Beyond Clinical Execution

Management Built for Commercialization, Not Just Data

2025 executive hires signal preparation for launch:

- Andrew Obenshain (CEO): Former CEO of bluebird bio with deep commercialization experience at Sanofi & Merck.

- Dr. Jason Campagna (President R&D/CMO): Former CMO at Intercept Pharmaceuticals (developed obeticholic acid for liver disease)—brings specific MASH regulatory and clinical expertise

- Dr. Martine Zimmermann (EVP Regulatory): Former Head of Global Regulatory Affairs at Ipsen, with FDA liver division experience

This isn't a "let's get through Phase 3" team. This is a "we're preparing for NDA filing and product launch" team.

Asian Partnerships: Validation and Strategic Value

- China (CTTQ): $12M upfront, up to $320M in milestones for Greater China rights

- Japan/Korea (Hepalys): $10M upfront, up to $231M in milestones, with Inventiva retaining 30% equity stake in Hepalys

These partnerships accomplish three goals:

- Third-party validation of lanifibranor's commercial potential from sophisticated regional pharma

- Non-dilutive capital through upfront and milestone payments

- Retention of all Western market rights—the highest-value territories for pricing and reimbursement

The deals structure Inventiva to capture US/European value while monetizing Asian markets through partners.

Valuation Disconnect: The 1/15th Discount

Recent M&A transactions establish clear valuation benchmarks for late-stage MASH assets:

Pre-Approval Acquisitions:

- Akero (efruxifermin, injectable FGF21, Phase 2b):

Acquired by Novo Nordisk for $5.2B (2025) - 89bio (pegozafermin, injectable FGF21, Phase 3):

Acquired by Roche for $3.5B (2025)

Public Comparable:

- Madrigal (Rezdiffra, approved oral THR-β for MASH):

~$9.5B market cap

Inventiva current market cap: ~$600M

Inventiva valued at:

- 7% of Madrigal (approved oral agent)

- 12.5% of Akero (injectable, acquired pre-approval)

- 18.5% of 89bio (injectable, acquired pre-approval)

Yet lanifibranor is:

- The only oral agent that hit both FDA surrogate endpoints in Phase 2b

- Optimized for the largest patient segment (MASH + T2D, ~15M patients in US)

- Delivering unique metabolic benefits (HbA1c -0.6-0.7%) that Rezdiffra doesn't provide

- Demonstrably combinable with SGLT2is to neutralize weight concerns

The Risk/Reward Framework:

Base Case (NATiV3 succeeds, ~55-60% probability):

- Comparable valuations suggest $4-6B range for pre-approval oral MASH asset with dual efficacy

- From $600M current: 7-10x upside

Bull Case (Superior data, ~20-25% probability):

- Phase 3 shows enhanced efficacy in diabetic subgroup, robust safety

- Strategic bidding from multiple pharma (oral + metabolic profile highly attractive)

- Target: $7-10B

- From $600M current: 12-17x upside

Bear Case (NATiV3 fails, ~20-25% probability):

- Asian partnerships continue, cash position ~€150M

- Exploratory cohorts may salvage value

- Realistic floor: $150-250M

- From $600M current: 60-75% downside

Probability-weighted: ~8x expected return, or 3.5-4:1 risk/reward ratio.

Even conservative assumptions (lower success probability, higher bear case weighting) yield 2.5-3:1 risk/reward, attractive for clinical-stage biotech.

Financing & Capital Structure: Runway Secured, Dilution Reality

Current Liquidity (as of June 30, 2025):

- Cash & equivalents: €122.1M

- Short-term deposits: €24.6M

- Total: €146.7M

- Estimated runway: Through Q3 2026

October 2024 Structured Financing:

Inventiva closed €348M ($375M USD) from top-tier biotech VCs:

- New Enterprise Associates (NEA)

- BVF Partners

- Samsara BioCapital

This was the largest financing in French biotech history and eliminated all financing risk through the Phase 3 data catalyst.

October 2025 ATM Program:

Filed $100M At-The-Market equity program with Piper Sandler, providing:

- Opportunistic capital access without commitment

- 30% annual dilution cap per French regulations

- Dollar-capped (not share-capped)—actual dilution depends on execution price

The Dilution Reality:

The structured financing created a warrant structure investors must understand:

- T2 BSAs - Prefunded warrants 43.4M shares €0.01

- T3 BSAs "Success Warrants" 77.3M shares at €1.50 (Positive Phase 3 only)

- EIB warrants 10M shares €4.02~3.95

- Employee Otions etc.. 14M shares

- ATM $100M which can be tapped anytime (as per PR on Oct 14, 2025)

Maximum theoretical dilution: ~85-90% if every instrument exercises.

Critical distinction:

The largest component—T3 "success warrants" (77.3M shares, ~56% dilution)—only exercises if Phase 3 succeeds and delivers positive topline results by June 2027.

This is "good dilution" aligned with value creation. It occurs precisely when the company's valuation multiplies 7-13x to comparable transaction levels ($3.5-5.2B).

Example: If Phase 3 succeeds and Inventiva is valued at $5B with full dilution, existing shareholders' stake is diluted but the absolute value is still $2.2B vs $650M today—a 3.7x return despite 56% dilution.

The T2 pre-funded warrants (43.4M) are economically already issued—investors paid €1.34 upfront with only €0.01 remaining to exercise. This represents ~31% dilution already embedded in the structure.

Bottom line: Fully capitalized through the most important inflection point, with the largest dilution component tied to clinical success. Even assuming full dilution, base case scenarios deliver 4-6x returns given the valuation disconnect to comparables.

The Investment Thesis: A Rare Setup in Plain Sight

Inventiva represents a convergence of factors rarely seen together in biotech:

✅ Strong Phase 2b data — first and only drug to hit both FDA endpoints

✅ Fully enrolled Phase 3 — no execution risk, data H2 2026

✅ Capitalized through catalyst — €147M cash, and additional

✅ Commercial-ready management — team built for launch, not just trials

✅ Strategic validation — Asian partnerships with $550M+ milestone potential

✅ $30-90B market opportunity — approved therapies establish reimbursement

✅ Clear regulatory path — BTD, FTD granted. FDA precedent set, tox package approved for NDA

✅ Differentiated positioning — oral, optimized for massive MASH + T2D segment

The Abivax parallel is instructive: Strong Phase 2b data, fully enrolled Phase 3, small French company, minimal US awareness. Then Phase 3 success. 500% move in a day and continuous momentum thereafter.

The difference: We're early. The market hasn't woken up yet. Valuation remains way below comparable companies at late clinical stage with MASH.

Big Pharma has spoken with their checkbooks: they paid $3.5-5.2B for late-stage MASH assets pre-approval. They're not waiting for commercialization—they're securing strategic positions before approval.

Inventiva—oral, dual efficacy, optimized for the diabetic MASH population, combinable with SGLT2 —fits precisely into this landscape.

The Key Risks:

⚠️ Clinical: Phase 3 does not replicate Phase 2b (though the blinded interim indicates consistency), and the plateau effect for weight gain diminishes, leading to continuous gain instead.

⚠️ Competition: GLP-1s and Rezdiffra saturate market before lanifibranor launches

⚠️ Dilution: Up to 85-90% maximum dilution, though largest component tied to the success in Phase 3.

The Setup:

A well-designed, fully-funded, scientifically-validated Phase 3 trial in a $30-90B market, run by proven commercial operators, with clear regulatory precedent, trading much lower than the competition.

Yes, there will be dilution, up to 49-56% conditional on Phase 3 success. But even accounting for that reality, base case scenarios deliver 4-6x returns, bull cases 8-12x, with 3.5-4:1 risk/reward on probability-weighted outcomes.

The question isn't whether dilution will occur, it will.

The question is whether 7-10x upside on a binary clinical catalyst, with strong Phase 2b data, positive Phase 3 potential, and comparable asset validations at $3.5-5.2B, represents attractive risk/reward.

The only remaining question: Will the market recognize it before the data, or after?

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.