The $12B Alarm Bell: Smart Money is Buying Solid Biosciences ($SLDB) While Retail Investors are Sleeping

Novartis's $12B acquisition of Avidity just repriced the gene therapy market, yet Solid Biosciences lags far behind. Top institutional investors see de-risked biology and standout safety in SLDB's early data. Are retail investors missing one of the most asymmetric opportunity in biotech?

On October 26, 2025, the neuromuscular gene therapy space was rocked by a $12 billion earthquake.

That’s the price Novartis agreed to pay in cash to acquire Avidity Biosciences (NASDAQ: RNA). This wasn't a distressed asset sale; it was a massive, landscape-defining premium for Avidity's next-generation platform, which is still in clinical development.

This single transaction repriced the entire sector. And it has exposed one of the most glaring disconnects on the market today.

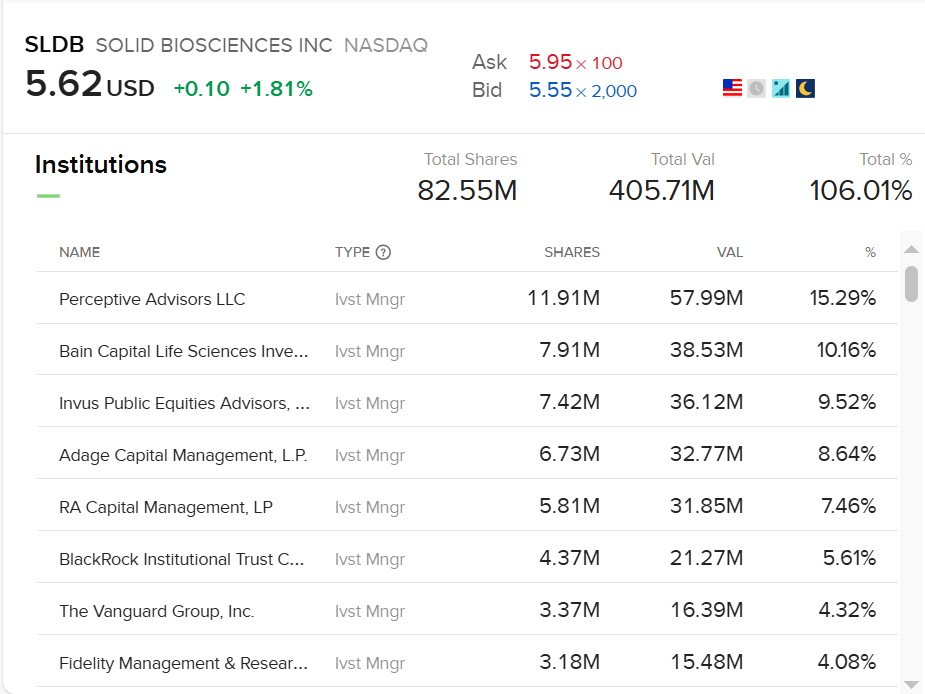

While the retail investors are distracted, top-tier institutional investors—the "smart money" in biotech—have been quietly building massive positions in a company that could be next: Solid Biosciences (NASDAQ: SLDB).

Look at the shareholder list. It reads like a "who's who" of biotech specialists: Perceptive Advisors, Bain Capital Life Sciences, RA Capital Management, Adage Capital, and Fidelity.

So what do they see that the rest of the market doesn't?

The Glaring Disconnect

First, look at the Duchenne muscular dystrophy (DMD) landscape post-acquisition:

- Avidity (RNA): Acquired for $12 Billion by Novartis.

- Dyne (DYN): A key competitor with a similar platform, trading at ~$2.4 Billion.

- Sarepta (SRPT): The first-to-market with an approved therapy, trading at ~$2.3 Billion after a brutal year.

- REGENXBIO (RGNX): Another promising gene therapy player, trading at ~$660 Million.

- Solid (SLDB): Showing potentially best-in-class data. Market Cap: ~$440 Million.

That is not a typo. Solid Biosciences, a company with a clean balance sheet, three clinical-stage programs, and data that rivals or exceeds its competitors, is trading for 4% of Avidity's acquisition price and significantly less than even REGENXBIO.

The market's reaction is straightforward: "It's just N=3 data." This is where Solid currently stands with its primary asset, SGT-003, based on preliminary results from its phase 1/2 study for DMD.

But the institutional thesis is more sophisticated: In gene therapy, you don't need a large N to de-risk the biology. You just need to answer three critical questions. And with its N=3 data, Solid has answered all three with a resounding "yes."

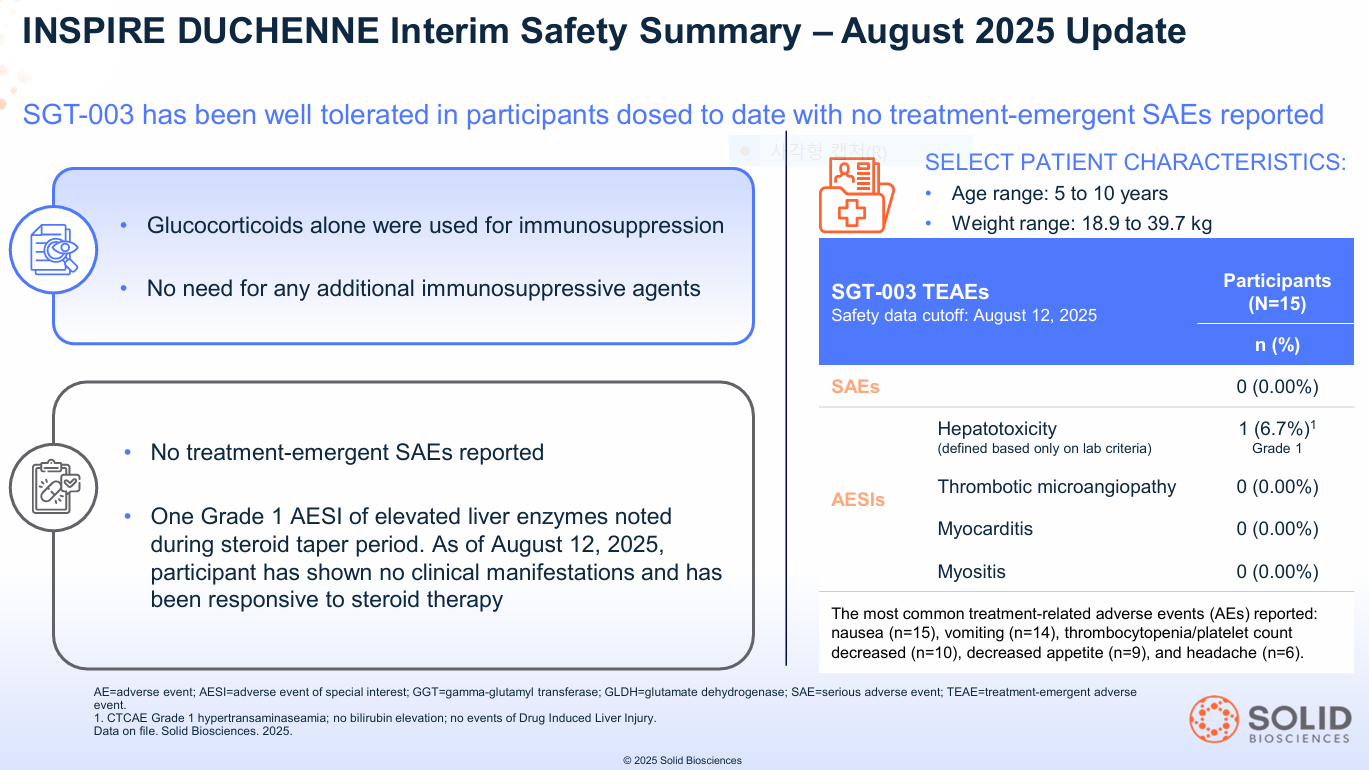

De-Risking Hurdle #1: Is It Safe? (The N=15 Data)

Before you ask if a gene therapy works, you must ask if it's safe. Gene therapy's historical Achilles' heel is that the AAV "truck" (the capsid) used to deliver the gene can be attacked by the body's immune system or cause severe liver toxicity (hepatotoxicity).

This isn't a theoretical risk; it is the single biggest barrier that has plagued Duchenne gene therapy. Pfizer's late-stage program was halted after multiple patient deaths. Sarepta's approved Elevidys carries warnings for acute serious liver injury, immune-mediated myositis, and myocarditis, and tragically reported a patient death from acute liver failure in March 2025.

This context is what makes Solid’s safety data so revolutionary.

Solid’s lead asset, SGT-003, has sailed over this hurdle. As of August 2025:

- 15 participants have been dosed.

- There have been zero treatment-emergent Serious Adverse Events (SAEs).

- The therapy uses a simple steroid-only regimen, not the complex cocktails (like sirolimus or eculizumab) required by competitors.

This clean safety profile in 15 patients is arguably the most significant de-risking event for the entire platform. It suggests the proprietary AAV-SLB101 capsid is doing its job: efficiently targeting muscle while reducing liver exposure.

De-Risking Hurdle #2: Does The Biology Work? (The N=3 Data)

First, what is Duchenne? It's a devastating muscle-wasting disease. Boys are born without the genetic code for dystrophin, a critical protein that acts as a "shock absorber" for muscle cells. Without it, every movement—walking, running, even breathing—causes muscle fibers to tear themselves apart, eventually being replaced by scar tissue (fibrosis). This leads to loss of ambulation in the early teens and fatal heart or respiratory failure.

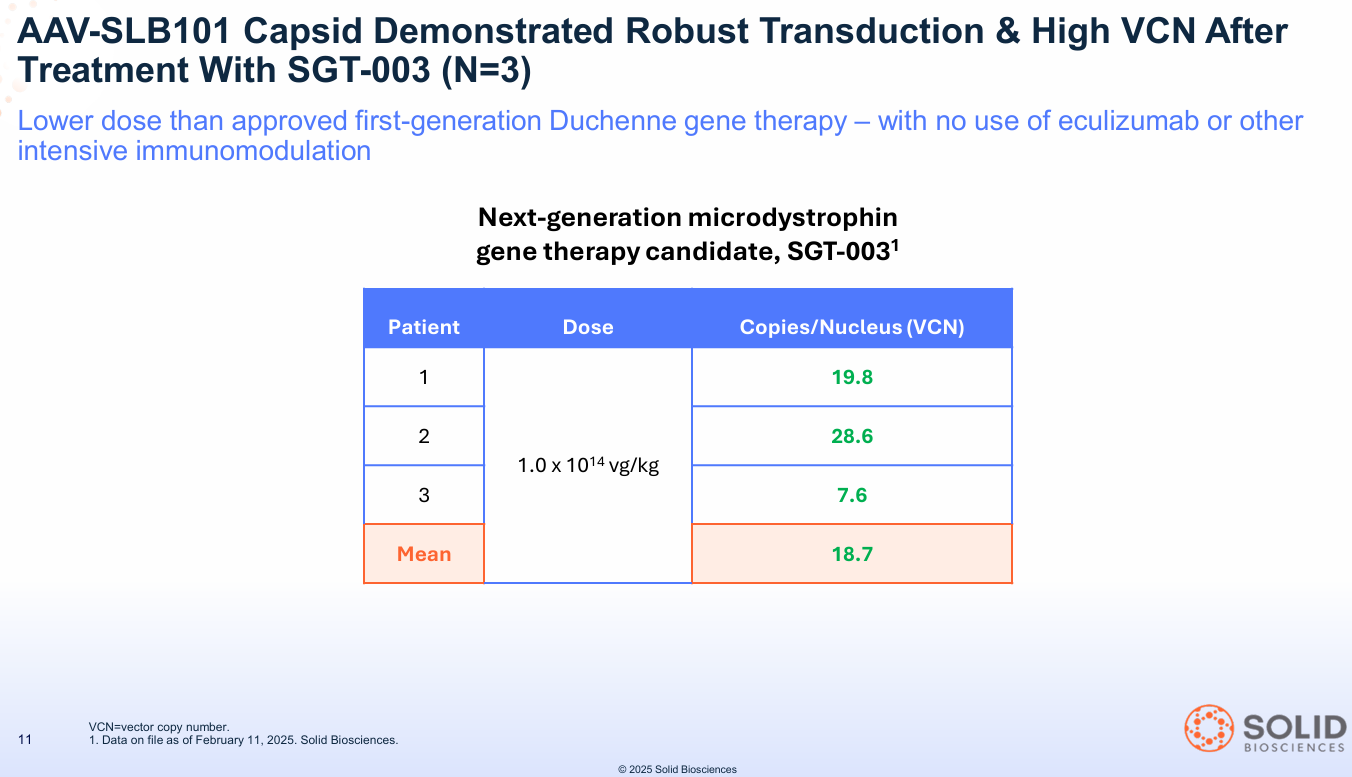

With safety established, institutions applied a simple framework to the N=3 cohort data from Day 90.

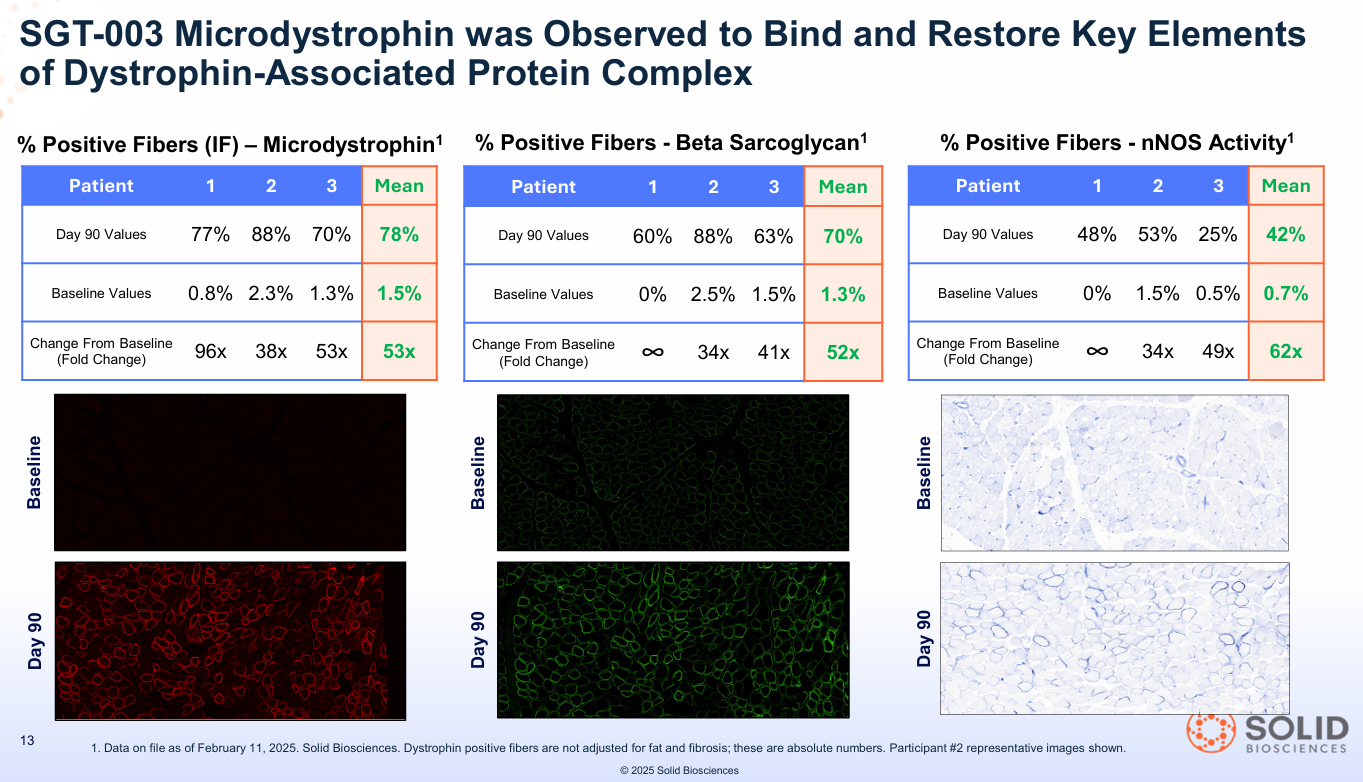

Question 1: Can you deliver the vector to the target tissue? Answer: YES. The therapy showed a mean Vector Copy Number (VCN) of 18.7.

- What this means: VCN is a simple "shipping receipt." It counts how many copies of the new gene actually arrived inside the muscle cells. An 18.7 mean is considered incredibly robust and confirms the AAV-SLB101 capsid is an effective delivery truck.

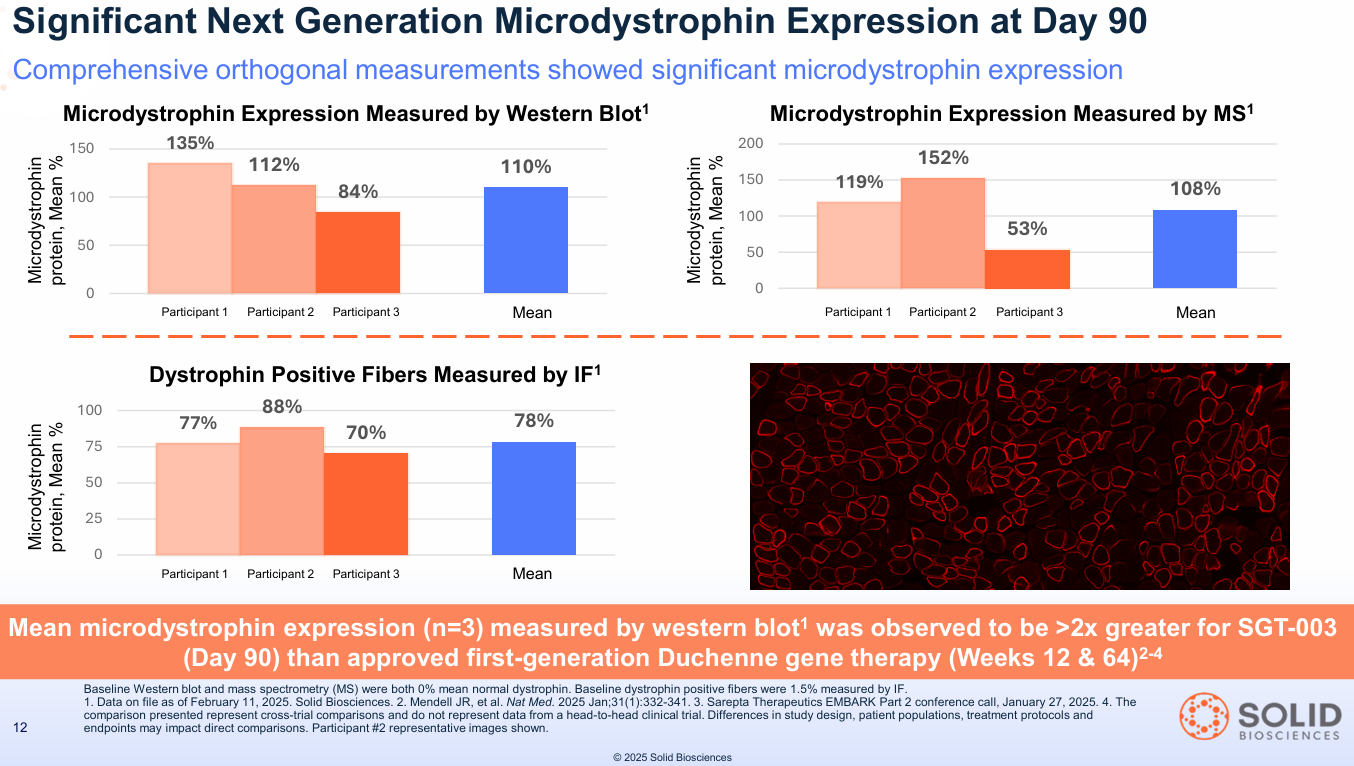

Question 2: Can you express protein at therapeutic levels? Answer: YES. The N=3 cohort showed a mean of 110% dystrophin expression (measured by Western Blot).

- What this means: The new gene "factories" aren't just delivered; they are turned on. A Western Blot measures the resulting protein. Hitting 110% of normal levels is staggering. It's not just a partial fix; it's full restoration of the very protein these boys are missing. For context, Sarepta's approved Elevidys showed approximately 40-50% expression at similar timepoints.

Question 3: Does the expressed protein function properly? Answer: YES. The data showed 70% of fibers also restored beta-sarcoglycan, proving the new dystrophin was correctly assembling the key Dystrophin-Associated Protein Complex (DAPC).

- What this means: This proves the new protein isn't just "floating around." It's properly docked at the cell membrane, acting as the "shock absorber" and rebuilding the muscle's structural support wall. The scaffolding isn't just there; it's working.

Comparison: How Does SGT-003 Stack Up Against REGENXBIO's RGX-202?

REGENXBIO (RGNX) is another key player showing strong early data with its candidate, RGX-202, also currently valued significantly higher than Solid (~$660M vs. ~$440M). Like Solid, REGENXBIO has reported zero SAEs in their Phase 1/2 trial to date, a crucial point of differentiation from Pfizer and Sarepta.

However, key differences remain that favor Solid's profile, particularly at its current valuation:

- Expression Levels: While RGNX has shown impressive expression in some younger patients (even exceeding 100%), the levels appear more variable across their initial cohorts (ranging from ~31% to 122%) compared to Solid's consistent mean of 110% in its first three patients.

- Immunosuppression: RGNX uses a more complex, multi-drug immunosuppression regimen (including eculizumab and sirolimus) over a longer period (~3 months). Solid's ability to achieve robust expression with only ~30 days of steroids is a significant potential advantage for patient safety and convenience.

- Microdystrophin Construct: This is a critical biological difference. RGNX's RGX-202 includes the C-Terminal (CT) domain of dystrophin, which they believe enhances muscle resilience. Solid's SGT-003 instead includes the nNOS-binding domain.

Comparison vs competition

| Metric | SLDB (SGT-003) | RGNX (RGX-202) | SRPT (Elevidys) |

|---|---|---|---|

| Expression (WB) | 110% (mean) | 31–122% (variable) | ~40–50% |

| Immunosuppression | Steroids ×30d | Multi-drug ×3mo | Complex |

| nNOS Domain | Yes (42% fibers) | No | No |

The "Best-in-Class" Kicker: Why nNOS Matters (The N=3 Data)

This nNOS difference is where the information asymmetry lies for Solid. The N=3 data didn't just show SGT-003 works; it showed it might be better than the approved standard of care and potentially other competitors like RGX-202.

1. The nNOS Advantage: Sarepta's Elevidys and REGENXBIO's RGX-202 lack the nNOS-binding domain. SGT-003 includes it.

- What this means: In healthy muscle, nNOS helps produce nitric oxide, which tells blood vessels to relax during exercise, bringing in more oxygen. In Duchenne, this is broken, and muscles essentially suffocate themselves during use, causing even more damage (this is "functional ischemia"). By restoring nNOS to the membrane (seen in 42% of fibers in the SGT-003 N=3 cohort), Solid's therapy could be the first to fix this core part of the disease, protecting muscle from its own activity in a way competitors might not.

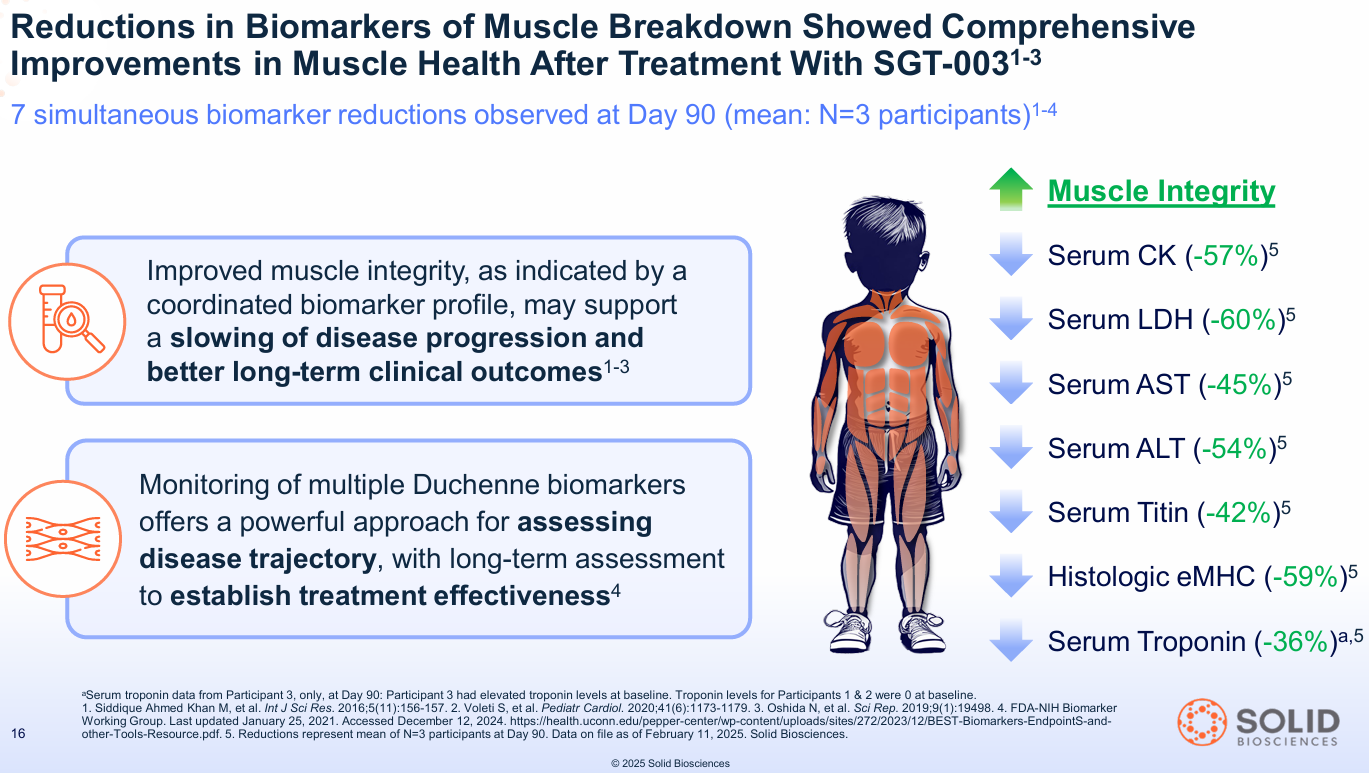

2. The Biomarker Dashboard: This is the mic drop. Solid measured seven different biomarkers for muscle damage, inflammation, and breakdown. At Day 90, all seven moved favorably, showing a deep, systemic reduction in the Duchenne disease process.

- What this means: Think of biomarkers like CK, LDH, and Titin as "muscle guts" that leak into the blood when muscle fibers are destroyed. A Duchenne patient's blood is full of them. Seeing a -57% drop in CK or a -42% drop in Titin is a direct, quantifiable signal that less muscle is being destroyed.

- Seeing a -59% drop in eMHC (a marker of constant, failed repair) and a -36% drop in Troponin I (a specific marker for heart damage) is even more profound.

- Serum CK (muscle damage): -57%

- Serum LDH (muscle damage): -60%

- Serum Titin (muscle breakdown): -42%

- Histologic eMHC (dystrophic regeneration): -59%

- Serum Troponin I (cardiac damage): -36% (in the one patient with an elevated baseline)

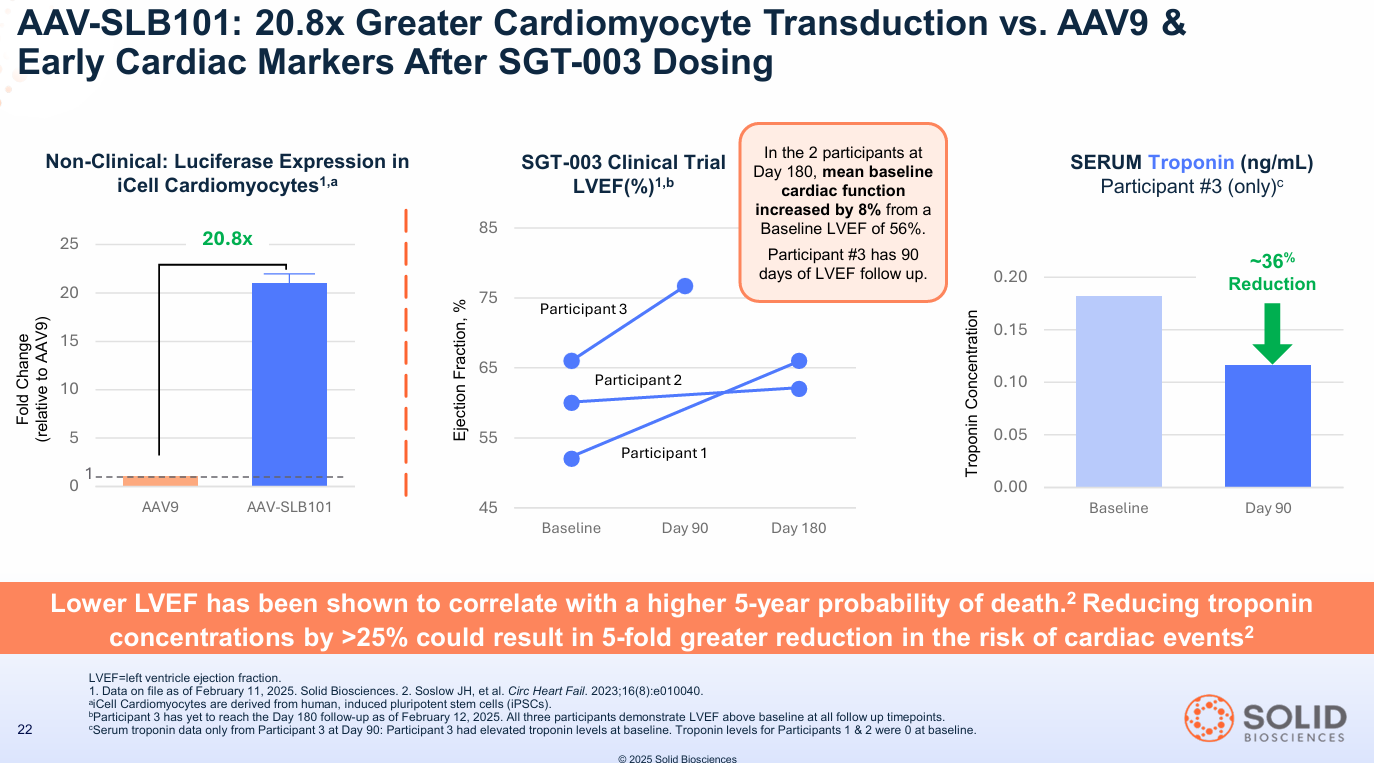

This isn't just one metric; it's the entire dashboard flashing green. It suggests the muscle isn't just being repaired; it's stabilizing. This was further supported by early cardiac data showing an 8% improvement in LVEF (cardiac function) in the first two patients at Day 180.

When institutions see high VCN, 110% consistent expression, DAPC restoration, unique nNOS localization, seven positive biomarkers, a clean safety profile in 15 patients with only steroids, and an early cardiac signal, they aren't guessing. They are betting that functional benefit is now more probable than not, and that this specific biological profile could be best-in-class.

The "Free" Pipeline: Three Shots on Goal

At a ~$440 million market cap, Wall Street is valuing Solid as if SGT-003 is its only asset and has a high probability of failure. This valuation assigns zero value to the rest of the company.

The smart money knows the pipeline provides three additional, uncorrelated shots on goal.

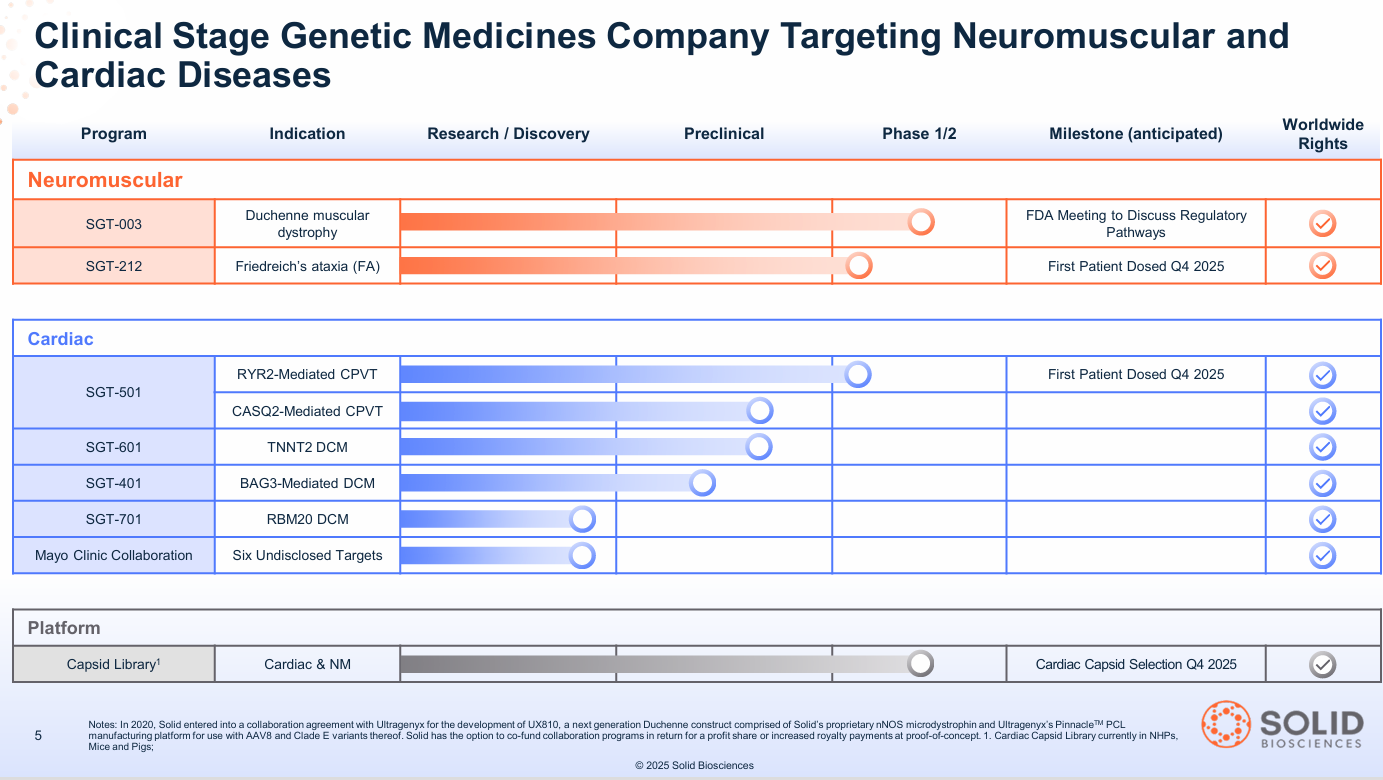

- 1. Friedreich's Ataxia (SGT-212): A debilitating disease that causes progressive nerve damage (ataxia) and a fatal weakening of the heart muscle (cardiomyopathy). Solid's first-in-class dual-route therapy (IV for the heart + direct-to-cerebellum for the brain) is a "whole-body" solution. The IND is cleared, and Phase 1b is initiating in Q4 2025.

- 2. CPVT (SGT-501): A "sudden death" genetic arrhythmia. It's an "electrical" heart problem where a surge of adrenaline (from exercise or excitement) can trigger a fatal cardiac arrest in otherwise healthy-looking young people. SGT-501 has IND clearance and FDA Fast Track designation. Phase 1b is also initiating in Q4 2025.

- 3. The Platform (AAV-SLB101): The proprietary capsid that makes this all possible is a valuable asset in itself. It has already been validated by over 25 licensing deals with academic labs and corporations, creating a hidden "infrastructure" value for the company.

The Asymmetric Bet

This is the setup that hedge funds dream of. With $268.1 million in cash (as of Q2 2025) and a runway into H1 2027, there is no near-term dilution risk. The company is funded to hit its major catalysts.

- Bear Case: The N=3 data regresses. Functional outcomes are flat. The stock drifts to its cash + platform value. Downside: ~50%

- Base Case: The data holds. SGT-003 shows stabilization and is eventually approved as a differentiated therapy. The FA and CPVT programs show early promise. Upside: 3-5x (now looks conservative)

- Bull Case: The data proves SGT-003 is "best-in-class." The nNOS and cardiac benefits are confirmed. The FA/CPVT programs work. The platform is seen as a new standard. Upside: 10-20x+

The $12 billion Novartis/Avidity deal just validated the bull case for the entire sector. It proves that Big Pharma will pay astronomical prices for de-risked, next-generation platforms.

The market sees SLDB at ~$440 million and thinks "high-risk, N=3."

Smart money (Perceptive, Bain, RA Capital) sees the same price and thinks, "The biology is de-risked, the safety is de-risked, the immunosuppression looks simpler, the nNOS angle is unique, and we get three clinical-stage assets for the price of one-tenth of a competitor."

That is an asymmetry you don't see often. And the clock is ticking. Solid is meeting with the FDA to discuss regulatory pathways in Q4 2025. The information gap is closing.

Upcoming Catalysts & Timeline

Solid Biosciences is poised for a data-rich period over the next 12-18 months:

- Q4 2025:

- SGT-003 (Duchenne): ⭐ Q4 2025 FDA meeting planned (potential for accelerated approval path)

- SGT-003 (Duchenne): Initiate separate randomized, placebo-controlled trial outside the US.

- SGT-003 (Duchenne): Expectation to have dosed a minimum of 20 patients by year-end.

- SGT-212 (Friedreich's Ataxia): Initiate Phase 1b trial (first patient dosed).

- SGT-501 (CPVT): Initiate Phase 1b trial (first patient dosed).

- Platform: Final capsid selection from the first cardiac capsid library.

- 2026:

- SGT-003 (Duchenne): Readout of 48-week functional outcome data from initial patient cohorts.

- SGT-212 (FA) & SGT-501 (CPVT): Initial safety and biomarker data readouts from Phase 1b trials.

- Platform: Continued execution of AAV-SLB101 licensing deals.

- H1 2027:

- Current cash runway extends into this period, allowing execution through multiple key data points.

Investors should always remember that early trial data and high institutional ownership mean little if the follow-up data doesn't hold up. Adjust your positions accordingly.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.