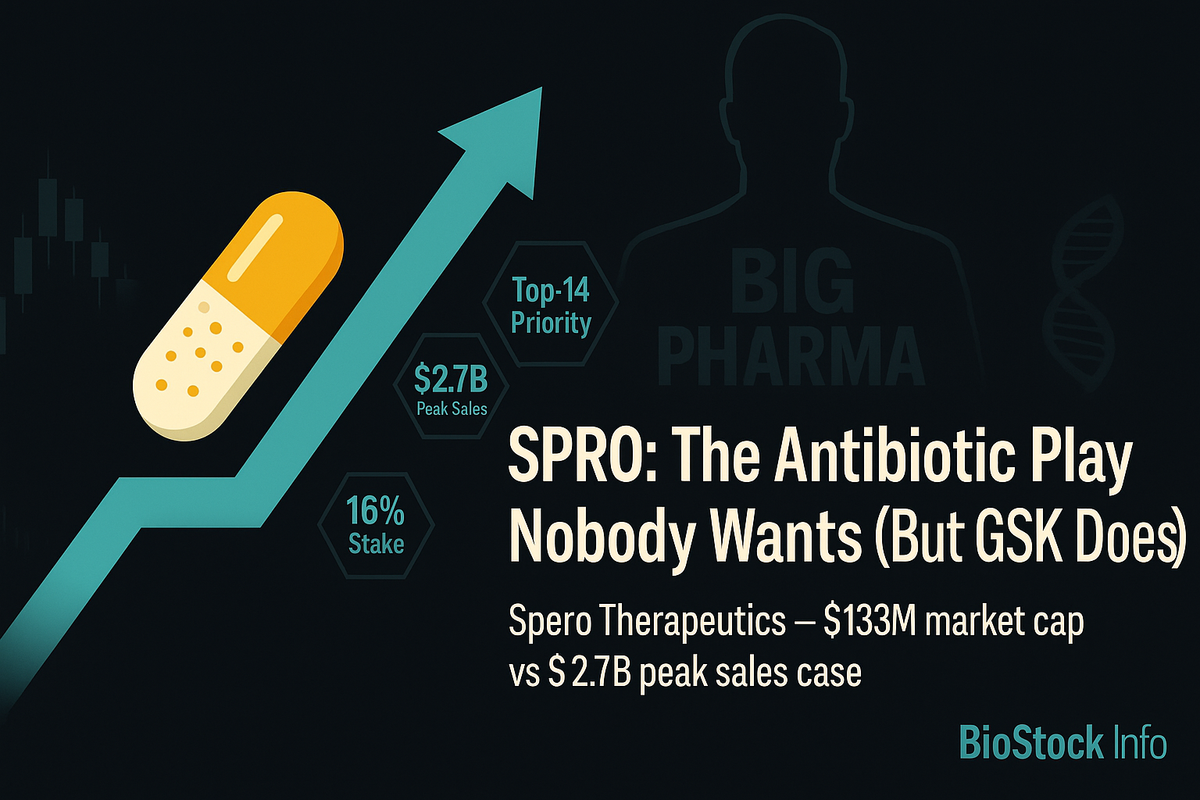

SPRO: The Antibiotic Play Nobody Wants (But GSK Does)

Spero Therapeutics sits at a $133 million market cap. GSK ranks its sole asset as a top-14 priority with $2.7 billion peak sales potential. Someone's wrong—and it's probably not the pharmaceutical giant holding 16% of the shares.

When was the last time anyone got excited about an antibiotic? In an industry chasing billion-dollar oncology blockbusters and gene therapies, antibiotics are the overlooked stepchildren of biotech—unglamorous, undervalued, and often unprofitable. Yet here sits Spero Therapeutics at a $133 million market cap, with GSK ranking its sole asset as a top-14 priority with peak sales potential above $2.7 billion. The market is pricing SPRO like it's going nowhere. GSK is acting like it's going everywhere.

Someone's wrong. And the evidence suggests it's not the pharmaceutical giant holding 16% of the shares.

The Problem Nobody Talks About (But Everyone Pays For)

Every year, complicated urinary tract infections send hundreds of thousands of patients to hospitals for IV antibiotics. Not because doctors want to hospitalize them. Not because patients enjoy multi-day hospital stays. But because there's simply no other option when oral antibiotics fail against increasingly resistant bacteria.

The economic toll is staggering. Hospitalization for cUTI costs between $10,000 and $15,000 per patient in the United States. By 2011, annual costs had already hit $2.8 billion according to published studies. Today, GSK estimates the current standard of care contributes over $6 billion annually to healthcare costs. Those aren't projections—that's money already flowing through the system, year after year, for a problem that has no outpatient solution.

Here's the uncomfortable truth the market seems to be ignoring: complicated UTIs aren't rare, exotic conditions. They affect both men and women, particularly in older populations. For men, essentially any UTI is complicated by definition due to anatomical factors. These infections involve structural abnormalities, comorbidities like diabetes, or catheter-related complications. The bacteria responsible—primarily E. coli and K. pneumoniae—have developed extensive resistance to first-line oral antibiotics.

When fluoroquinolones, TMP-SMX, and oral β-lactams stop working, clinicians have exactly one reliable option: IV carbapenems in a hospital setting. It's resource-intensive, inconvenient, and expensive. But it works. Until now, that's been the end of the story.

What Makes This Different: The GSK Factor

Spero Therapeutics didn't invent tebipenem. They licensed it from Meiji Seika Pharma in 2017—a drug that had been safely used in Japan since 2009 for pediatric infections. The safety profile was established. The molecule worked. What Spero did was recognize that an oral carbapenem could fundamentally change how complicated UTIs are treated in the United States.

In 2022, after the FDA issued a Complete Response Letter requesting additional trials, Spero could have folded. Many biotechs do at that stage. Instead, they secured something rare: a strategic partnership with GSK that wasn't just licensing—it was a bet.

GSK didn't just write a check and walk away. They took over regulatory strategy, manufacturing, distribution, and commercialization. They currently hold over 16% of Spero's outstanding shares. And in May 2025, when the independent Data Monitoring Committee recommended stopping the Phase 3 PIVOT-PO trial early due to efficacy, GSK immediately announced plans for FDA submission by year-end 2025, with anticipated FDA action in the second half of 2026.

Look at GSK's Q2 2025 earnings report. On page one—not buried in footnotes but featured prominently—tebipenem HBr appears as one of 14 key opportunities with peak year sales potential above $2.7 billion. That's not speculative positioning for a minor asset. That's a portfolio drug GSK expects to launch and scale globally.

The strategic logic is compelling. GSK has extensive expertise in infectious disease. An FDA-approved oral carbapenem would be first-in-class. With GSK's global distribution network and established relationships with hospitals and payers, market uptake could be rapid. For patients, the value proposition is simple: avoid hospitalization, receive effective treatment at home, and significantly reduce the financial burden of care.

The Clinical Story: Why Early Termination Matters

Clinical trials don't stop early for mediocre results. When an independent Data Monitoring Committee reviews interim data and recommends halting enrollment due to efficacy, it means the treatment effect is sufficiently clear that continuing the trial would be ethically questionable—patients in the control arm are being denied a demonstrably better option.

PIVOT-PO achieved exactly that. After reviewing data from 1,690 patients, the IDMC recommended early termination. The study demonstrated non-inferiority compared to IV carbapenem therapy, the current gold standard. This wasn't a close call requiring statistical gymnastics. The efficacy signal was strong enough for the IDMC to make their recommendation after reviewing unblinded data.

More importantly, the trial was conducted under a Special Protocol Assessment agreement with the FDA. When the FDA agrees to an SPA, they're essentially validating that if the trial succeeds on its specified endpoints, the data should support approval. This dramatically de-risks the regulatory pathway. The Phase 3 trial hit its primary endpoint under SPA terms. That's not a guarantee—nothing in biotech is—but it raises the probability of approval substantially above typical clinical-stage assets.

The Competitive Landscape: First-In-Class Advantages

One reason antibiotics struggle for investor attention is the perception of a crowded field. Why would another antibiotic matter when dozens already exist?

Because resistance has rendered most of them ineffective for serious infections.

Oral carbapenems for complicated UTI treatment don't exist in the United States. Combinations of older antibiotics are attempted, but resistance rates continue climbing. ESBL-producing Enterobacteriaceae—bacteria that produce enzymes breaking down most β-lactam antibiotics—are increasingly common. Traditional oral options simply don't provide reliable coverage.

Tebipenem HBr delivers carbapenem-class coverage orally, including activity against ESBL-E. That's the key differentiator. It's not incrementally better than existing oral options. It provides the same spectrum as IV carbapenems that clinicians already trust, in a form that doesn't require hospitalization.

The competitive analysis is straightforward: Spero/GSK's tebipenem is the most clinically advanced oral carbapenem for cUTI. No other candidate is close. Being first-in-class in a large, underserved market with a clear clinical need creates meaningful barriers to future competition. By the time another oral carbapenem could reach approval, tebipenem would have established market presence, physician familiarity, and payer relationships.

The Financial Structure: Milestones and Runway

Here's where the risk profile becomes interesting. Following the receipt of a $23.8 million milestone payment from GSK in August 2025, Spero has funding secured through 2028. That eliminates the dilution risk that typically haunts clinical-stage biotechs. The company halted all other pipeline programs, dramatically reducing burn rate, and refocused entirely on obtaining FDA approval for tebipenem. During recent conference calls, management reiterated that regulatory approval is the singular value driver for the company.

The milestone structure with GSK tells you how much skin they have in the game:

- $25 million upon NDA filing (expected by year-end 2025)

- $101 million for first commercial sales in the US/EU (adjusted from $150 million due to early trial termination)

- Up to $225 million in additional milestones based on net sales thresholds

- Tiered royalties ranging from low single-digits to low double-digits on net sales

Additionally, Spero holds market exclusivity until 2041. If tebipenem reaches GSK's forecasted $2.7 billion in annual sales, Spero's royalty structure (1% up to $750M, 5% up to $1B, 10% beyond $1B) would generate approximately $190 million annually at peak.

The current market cap sits at $133 million. That's roughly five times the NDA filing milestone payment alone. If you believe GSK will file the NDA and the FDA will review it—not approve it, just review it—the current valuation already looks conservative considering the company received nearly $24 million in milestone payments just months ago and has another $25 million coming upon filing.

Why the Market Doesn't Care (Yet)

Antibiotics are boring. That's the simplest explanation for why SPRO trades where it does despite the GSK partnership, the completed Phase 3 trial, and the clear regulatory pathway.

Investors chase excitement. They want CAR-T therapies, CRISPR gene editing, and AI-driven drug discovery. They want stories they can tell at dinner parties. An oral carbapenem for urinary tract infections doesn't generate that kind of enthusiasm, even when it's backed by one of the world's largest pharmaceutical companies.

There's also skepticism about antibiotic approvals. The FDA scrutinizes antimicrobial drugs carefully, and rightfully so. Resistance concerns, appropriate use guidelines, and limited patient populations create regulatory complexity. Companies that successfully navigate antibiotic approvals often face narrow labeling and restricted use, limiting commercial potential.

But that's precisely what makes cUTI different. This isn't an antibiotic for mild infections where overuse breeds resistance. These are patients who would otherwise be hospitalized for IV treatment. The appropriate use case is clear, the patient population is substantial, and the standard of care is already carbapenem-based. Tebipenem isn't introducing a new antibiotic class to the market—it's making an existing, trusted class more accessible.

The company's management change also signals strategic direction. Bringing in CEO Esther Rajavelu in May 2025—an executive with extensive financial and operational expertise—suggests focus on either maximizing partnership terms or preparing for acquisition. Neither scenario is bad for shareholders.

The M&A Angle: Why GSK Might Buy Outright

GSK already owns 16% of Spero. They've committed to funding the regulatory process, manufacturing, and commercialization. They've designated tebipenem as a top-tier portfolio asset. At what point does it make sense to simply acquire the rest?

Post-approval, an acquisition becomes significantly more likely. Here's why: once the drug is approved and commercially available, Spero starts receiving milestone payments and royalties. GSK would be paying those out while already bearing all commercialization costs and risks. From a purely financial perspective, buying Spero eliminates ongoing royalty obligations and captures 100% of the economic value.

The strategic calculus favors acquisition. Tebipenem fits directly into GSK's infectious disease portfolio. The drug extends their antibiotics expertise into a first-in-class position. Global launch infrastructure is already in place. Acquiring Spero consolidates ownership, simplifies corporate structure, and eliminates any potential future disputes over territories, milestones, or royalty calculations.

What would that look like? Based on comparable biotech acquisitions and assuming successful approval, a buyout in the $14-21 range per share represents a reasonable valuation. That's not euphoric optimism—it's a multiple of current market cap that reflects established partnerships, approved drugs, and clear commercial pathways. Companies with less de-risked assets regularly command similar premiums.

The Risk Framework: What Could Go Wrong

Nothing in biotech is certain, and tebipenem is no exception. The risks are real and should be clearly understood.

First, approval isn't guaranteed. The Phase 3 trial was stopped early for efficacy, which dramatically increases approval probability, but regulatory reviews can uncover manufacturing issues, safety concerns, or data interpretation questions that delay or derail submissions. The FDA has denied approvals for drugs that appeared certain to succeed.

Second, timing matters. Any significant delays in the NDA filing, FDA review, or approval process will negatively impact the stock price. Biotech investors are notoriously impatient, and extended regulatory timelines create uncertainty that depresses valuations.

Third, antibiotics have narrow commercial applications by design. Approvals often come with restrictive labeling that limits prescribing. If tebipenem's label is narrower than expected—restricted to very specific patient populations or requiring prior authorization from payers—commercial potential could be significantly reduced.

Fourth, GSK could theoretically walk away. While their investment, partnership structure, and public statements all suggest strong commitment, corporate strategies change. If GSK deprioritizes antibiotics or faces internal restructuring, they could scale back their support. This seems unlikely given current positioning, but it remains a possibility.

Fifth, this is not a short-term trade. If you're looking for quick profits, SPRO probably isn't the right vehicle. The value realization depends on regulatory milestones that unfold over quarters, not weeks.

The Valuation Disconnect

Here's what we know with reasonable certainty:

- GSK considers tebipenem a top-14 portfolio asset with multi-billion peak sales potential

- Phase 3 trials met their primary endpoint under Special Protocol Assessment

- The drug addresses a $6 billion annual problem with no existing oral solution

- GSK controls regulatory, manufacturing, and commercialization processes

- Spero has funding through 2028 with no near-term dilution risk

- GSK owns 16% of Spero's shares and has already paid out nearly $24 million in milestone payments

- FDA action is anticipated in H2 2026

And the market values this at $133 million.

Either the market is correctly pricing in catastrophic failure—despite GSK's continued investment, positive trial results, and recent milestone payments—or there's a meaningful disconnect between current valuation and likely outcomes.

The scenario analysis breaks down roughly as follows:

Upside Case (FDA Approval + Commercial Launch): $7-9 per share based purely on milestone payments and discounted future royalties. Post-approval M&A: $14-21 per share.

Base Case (NDA Filing + Positive Review): $2.60-3.40 per share as regulatory process advances and approval probability increases.

Downside Case (Regulatory Failure or Partnership Termination): $0.20-0.50 per share, essentially valuing the company as a failed biotech with residual cash.

Current price around $2.32 places us near the lower end of the base case—suggesting the market is cautiously optimistic about NDA filing but remains skeptical about approval prospects despite the strong Phase 3 data and GSK's commitment.

The Contrarian Opportunity

The best investments often come from markets that fundamentally misprice assets due to sentiment rather than fundamentals. Antibiotics are unfashionable. Small-cap biotechs are risky. Regulatory pathways are uncertain. All true. But none of those factors change the underlying mathematics: a $133 million company with a top-tier pharmaceutical partner, completed Phase 3 trials, recent milestone payments received, and a clear path to a multi-billion dollar market.

The critical question isn't whether antibiotics are exciting. It's whether GSK—a $76 billion pharmaceutical company with extensive infectious disease expertise—is making a rational decision by prioritizing tebipenem in their portfolio and writing checks to Spero. If you believe GSK's strategic planning is sound, the current valuation looks increasingly difficult to justify.

This isn't a binary bet on miracle drug approval. It's a risk-adjusted play on regulatory execution by one of the world's most experienced pharmaceutical companies, in a therapeutic area with clear unmet need and established market dynamics. The stock could easily drift or decline if timelines extend. But the asymmetry between current valuation and even moderate success scenarios creates a compelling proposition for patient investors with appropriate risk tolerance.

What Changed: The Recent Move

When this analysis was initially compiled in September 2025, SPRO traded at $1.96 with a market cap of $109 million. Today, at $2.32, the stock has gained approximately 18% and now commands a $133 million valuation. Over the past six months, shares have surged 293.3%, driven primarily by the May 2025 PIVOT-PO trial results and subsequent developments.

The catalyst wasn't mysterious. When the Phase 3 trial stopped early for efficacy, the stock initially surged over 198% in a single day. It has since consolidated but maintained substantial gains as investors digest what early trial termination actually means for approval probability.

More significantly, in August 2025, Spero received a $23.8 million milestone payment from GSK—tangible validation that the partnership isn't just strategic posturing. GSK doesn't write eight-figure checks for programs they're planning to abandon. That payment extended Spero's cash runway from mid-2026 to 2028, eliminating near-term dilution concerns and providing a cushion through the approval process.

The market is beginning to recognize what was evident months ago: this isn't speculative science. It's late-stage regulatory execution with a committed partner. Yet at current prices, SPRO still trades at barely five times the next milestone payment due upon NDA filing. For context, that filing is expected within weeks, not years.

What's particularly interesting is the timing. The stock has moved, but it hasn't exploded. It's not trading at $5 or $7 where approval optimism would be fully priced in. It's trading where investors are saying "maybe this works, but we're not convinced yet." That creates opportunity for those willing to look past the antibiotic stigma and focus on execution.

The next catalysts are clear: NDA filing triggers a $25 million payment and should propel the stock toward the $2.60-3.40 range if GSK executes on their stated timeline. FDA acceptance and PDUFA date assignment would further validate the pathway. And approval—if it happens—fundamentally revalues the entire thesis.

For those tracking this story, the recent price appreciation isn't the end of the move. It's the market slowly waking up to what's been obvious in the partnership structure, clinical data, and financial terms all along. GSK is betting big. The question is whether retail investors will recognize that before the next milestone payment forces a revaluation.

The Bottom Line

Spero Therapeutics trades like a forgotten clinical-stage biotech. But it's not. It's a late-stage regulatory asset backed by GSK, targeting a $6 billion annual problem, with exclusivity through 2041 and no significant competition. The market treats it like it's fighting for survival. GSK treats it like a top-tier portfolio asset and backs that treatment with milestone payments.

One of them is right.

The stock surged after PIVOT-PO's early termination in May, received another boost with August's milestone payment, and now sits in a consolidation pattern as the market awaits NDA filing. But the fundamental thesis hasn't changed. If anything, it's strengthened as GSK moves forward with filing plans and continues deploying capital into the program.

For investors willing to hold through regulatory timelines and accept biotech risk, SPRO represents something increasingly rare: a materially de-risked asset trading at a material discount to probable outcomes. It won't appeal to everyone. Antibiotics don't generate Silicon Valley-style hype. But sometimes the best opportunities hide in the sectors everyone ignores.

The market is betting GSK got it wrong. The financials, clinical data, partnership structure, and actual cash flows suggest otherwise. Time will tell which side of that bet proves correct. But at a $133 million market cap—barely more than one year of potential peak royalties—you're not paying much for the optionality.

The NDA filing is expected by year-end 2025. FDA action is anticipated in H2 2026. Those aren't distant hypotheticals. They're near-term events that will force the market to reassess whether a GSK-backed, first-in-class oral carbapenem with completed Phase 3 trials deserves to trade like a speculative long-shot or a legitimate late-stage commercial opportunity.

Position accordingly.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.