When a 110% Price Gap Turns Into a Trading Halt Nightmare: The Inventiva S.A. ADR Story ($IVA)

A 70% gain in two weeks should feel like victory. Instead, it exposed one of the most dangerous traps in biotech investing, and a lesson every ADR trader needs to know.

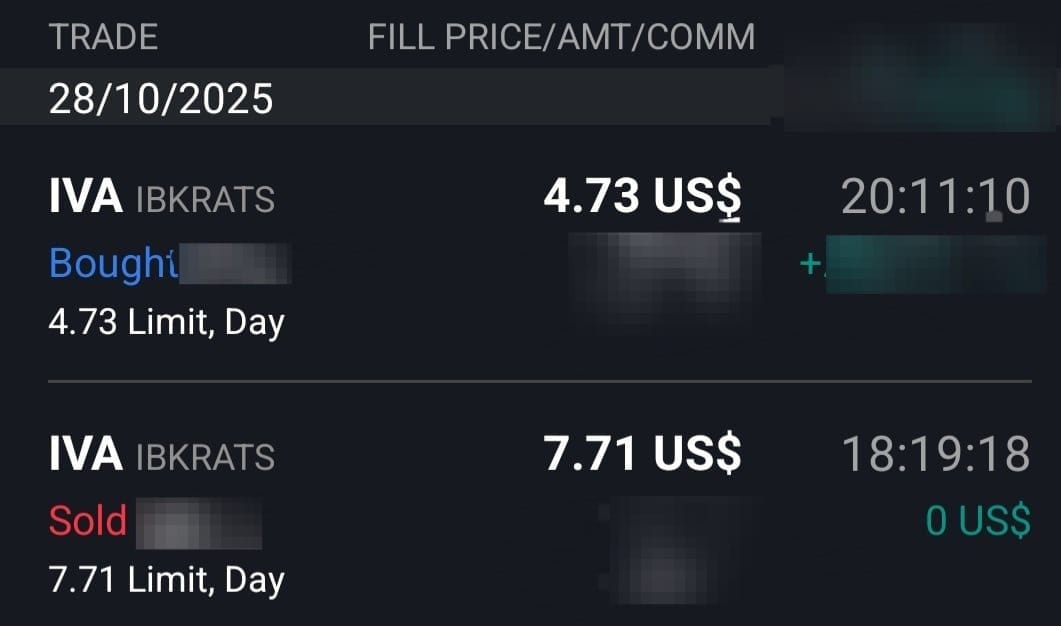

I closed my Inventiva S.A. ($IVA) position on NASDAQ with a 70% gain in less than two weeks. Then I shorted it at $7.71 and captured another 38% as it crashed in under two hours.

This isn't a victory lap. This is a warning.

The Setup: When Markets Stop Making Sense

Inventiva trades on two exchanges: Euronext Paris (the primary listing) and NASDAQ (as an ADR). The ratio is 1:1. The EUR:USD rate is roughly 1:1.16. Under normal conditions, the price gap between these two listings rarely exceeds 10%—market makers ensure arbitrage opportunities don't persist.

Starting October 14th, something broke.

The trigger: Inventiva announced a $300M shelf offering with $100M available immediately for an at-the-market (ATM) sale—exclusively on NASDAQ. The company chose NASDAQ despite higher average volume on the Paris exchange.

The Gap That Shouldn't Exist

Over the next two weeks, an impossible divergence emerged:

- French exchange (IVA FRA): Constant decline until 28th of October

- NASDAQ (IVA USA): Climbing aggressively, hitting $7.98

At peak, the gap reached almost 110%.

Think about that. You could theoretically buy shares in Paris and immediately sell them on NASDAQ for a guaranteed double. This isn't alpha. This isn't edge. This is broken market infrastructure.

Daily volatility on NASDAQ swung 20%+ regularly. Something was deeply wrong.

The Collapse

October 28th, IVA NASDAQ peaked at $7.98.

Within three hours: $7.98 → $4.51

Three consecutive trading halts due to volatility. Retail investors trapped. The French price? Still hovering around €3.00-$3.30 ($3.3-$3.84).

What happened?

The most likely scenario: sophisticated traders were executing a cross-exchange arbitrage. Buy in Paris, convert shares to NASDAQ ADRs (a process that takes several days), dump on NASDAQ retail at inflated prices. The gap was too large, too persistent, and too profitable not to exploit.

When the selling pressure finally overwhelmed the momentum buyers, there was no support. Market makers failed. The structure collapsed.

Why This Matters Beyond IVA

This isn't just an Inventiva problem. It's an ADR structural risk that every biotech investor needs to understand.

ADRs create opportunity—and danger:

- Currency conversion delays

- Multi-day settlement periods for cross-exchange transfers

- Different trading hours

- Liquidity mismatches

- Market maker failures during extreme moves

I hold another ADR position, $IMRN (NASDAQ), which primary stock is $IMC (ASX), with a 1:40 ratio. I watch both tickers constantly because I've seen this movie before.

The Lesson: Always Track the Primary Listing

If you hold any ADR, add the original listing to your watchlist immediately. Not as a suggestion, as a requirement.

Key monitoring rules:

- Know the exact conversion ratio

- Factor in real-time FX rates

- Set alerts when the price gap exceeds 15%

- Never trust a rally that only exists on one exchange

- Watch for abnormal volume patterns

In my case, I recognized the gap was unsustainable. I exited my long position before the collapse. I opened a short when IVA was $7.71 with the French shares still near €3.40, I opened a short. The correction was inevitable—just a question of when. What was surprising was how quickly it happened, allowing me to close the short position in a matter of hours rather than days.

Where $IVA Stands Now

I remain on the sidelines. My bullish thesis on Inventiva's science hasn't changed—the fundamentals that attracted me initially are still intact. But until the pricing discrepancy resolves and market structure stabilizes, this is a broken stock.

The company has funding. The pipeline has promise. But when a stock can drop 43% in three hours with multiple trading halts, something beyond science is at play.

Current status: Monitoring. No position. Waiting for normal market behavior to return.

The Uncomfortable Truth

Market makers are supposed to prevent this. Regulators are supposed to catch this. Neither did.

Retail investors got crushed. Sophisticated players likely made millions on both sides—pumping NASDAQ, then dumping before the collapse. The 110% gap wasn't an accident. It was a feature, not a bug.

This is why you track the underlying exchange. This is why you question impossible moves. This is why you take profits when nothing makes sense.

I got lucky with timing. Most didn't.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.