Janux Therapeutics ($JANX): The "Pluvicto Killer" Thesis Is Alive, But the Hype Had to Die First

In the high-stakes world of biotechnology, "good" is often not enough when the market is pricing in "perfection." Yesterday, Janux Therapeutics ($JANX) released updated Phase 1 data that triggered a sharp >40% sell-off. The market’s simplistic algorithm—"No massive beat on the headline number = Sell"—wiped out months of gains in minutes.

For regular readers of Biostockinfo.com, this volatility is a familiar friend. We saw a nearly identical pattern recently with MoonLake Immunotherapeutics ($MLTX): a stock runs up on massive expectations, delivers "good but complex" data, and flushes out the momentum traders. As I noted in my analysis of MoonLake, these moments of peak pessimism often create the most lucrative entry points for disciplined investors who know how to read the fine print.

So, let’s strip away the sentiment and look at the raw data. The market missed three critical nuances that suggest the Janux bull thesis is stronger today than it was yesterday.

1. The Safety "Fix" is Real

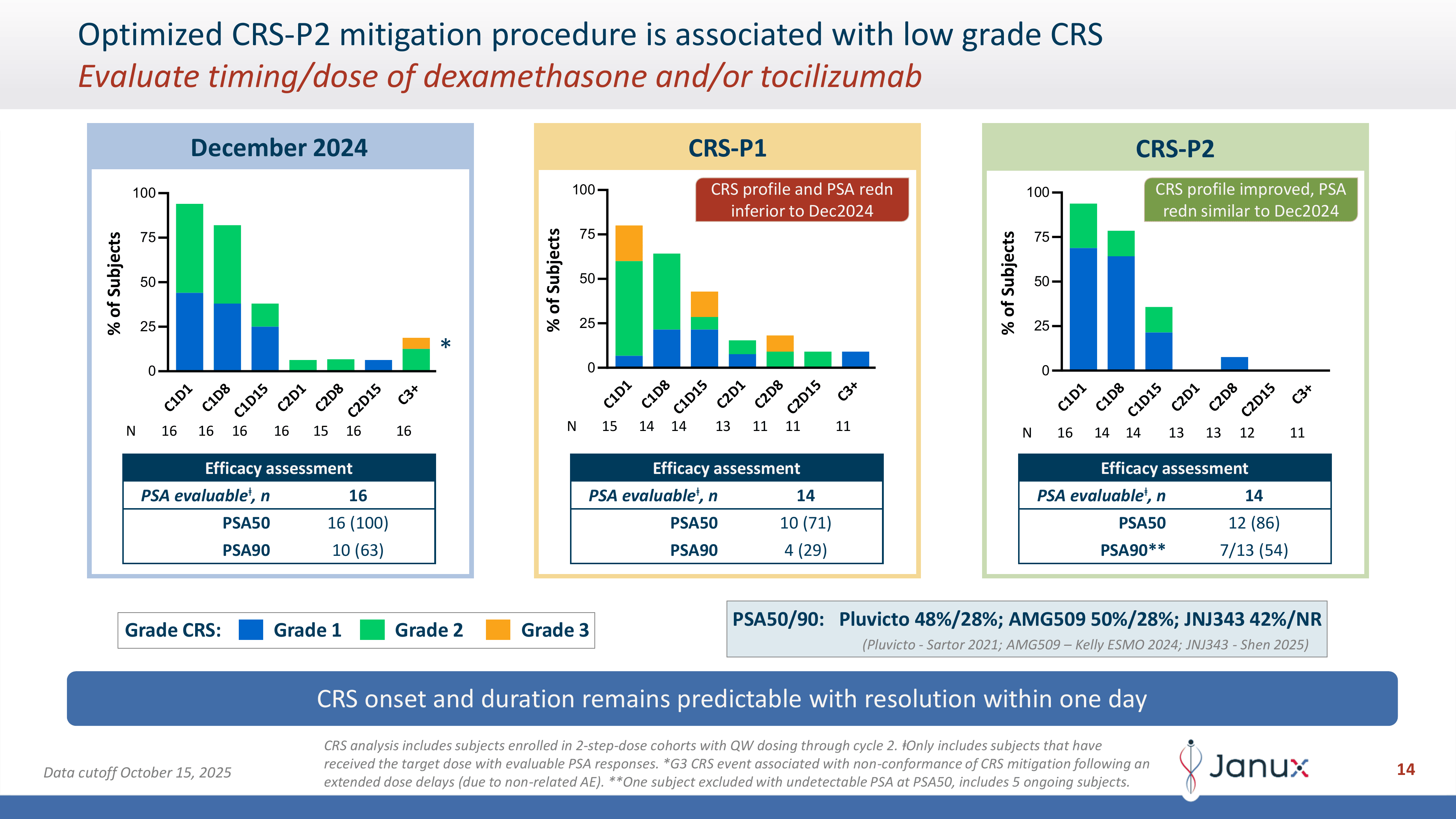

The initial panic was partially driven by fears regarding the "CRS mitigation strategy." Investors worried that trying to fix toxicity would blunt the drug's efficacy. The data proves the exact opposite.

As shown in the company's updated data, the new CRS-P2 protocol has effectively solved the safety problem without compromising potency.

- Safety: Under the new protocol, Grade 3 Cytokine Release Syndrome (CRS) events were eliminated (0% in CRS-P2 vs. previous cohorts). The toxicity is now predominantly low-grade (Grade 1/2), which is manageable in a community setting.

- Potency: Crucially, efficacy improved. In this optimized cohort, 86% (12/14) of patients achieved a PSA50, and 54% achieved a PSA90. This confirms that the "masking" technology is working: it protects healthy tissue while unleashing havoc on the tumor.

2. The "Hidden" Variable: Sicker Patients

The headline comparison pits JANX007’s 8.9-month median rPFS against the competition. On the surface, it looks like a tie with J&J’s pasritamig (7.85 months) or Novartis's Pluvicto (~8.7 months). But in oncology, you cannot compare efficacy numbers without comparing the patients.

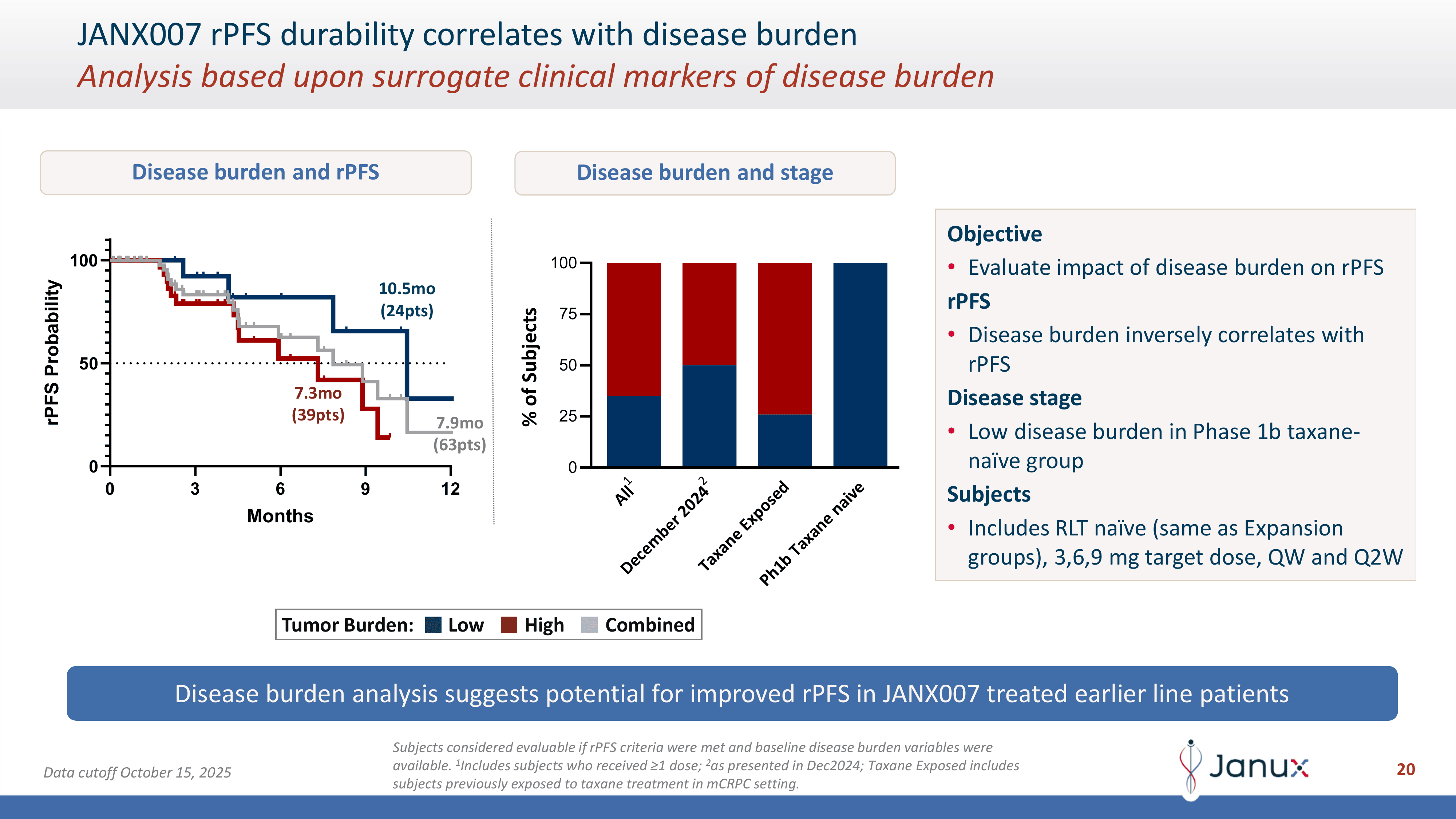

This slide is the most critical piece of evidence the market ignored. It demonstrates a clear inverse correlation: the less cancer a patient has, the better JANX007 works.

- The Competitor (J&J): The pivotal data for pasritamig came from a relatively "healthy" baseline population, with only ~2% of patients having liver metastases.

- The Reality (Janux): In stark contrast, Janux’s latest update included a significantly sicker population, with 14% liver metastases (and 29% visceral metastases overall).

Slide 20 shows that patients with "Low Tumor Burden" achieved a median rPFS of 10.5 months, compared to just 7.3 months for those with high burden. Given that JANX007 is moving into earlier lines of therapy (taxane-naïve), we can expect the pivotal numbers to trend closer to that 10.5-month figure, potentially beating the standard of care comfortably.

3. The "TCE Survival Bonus"

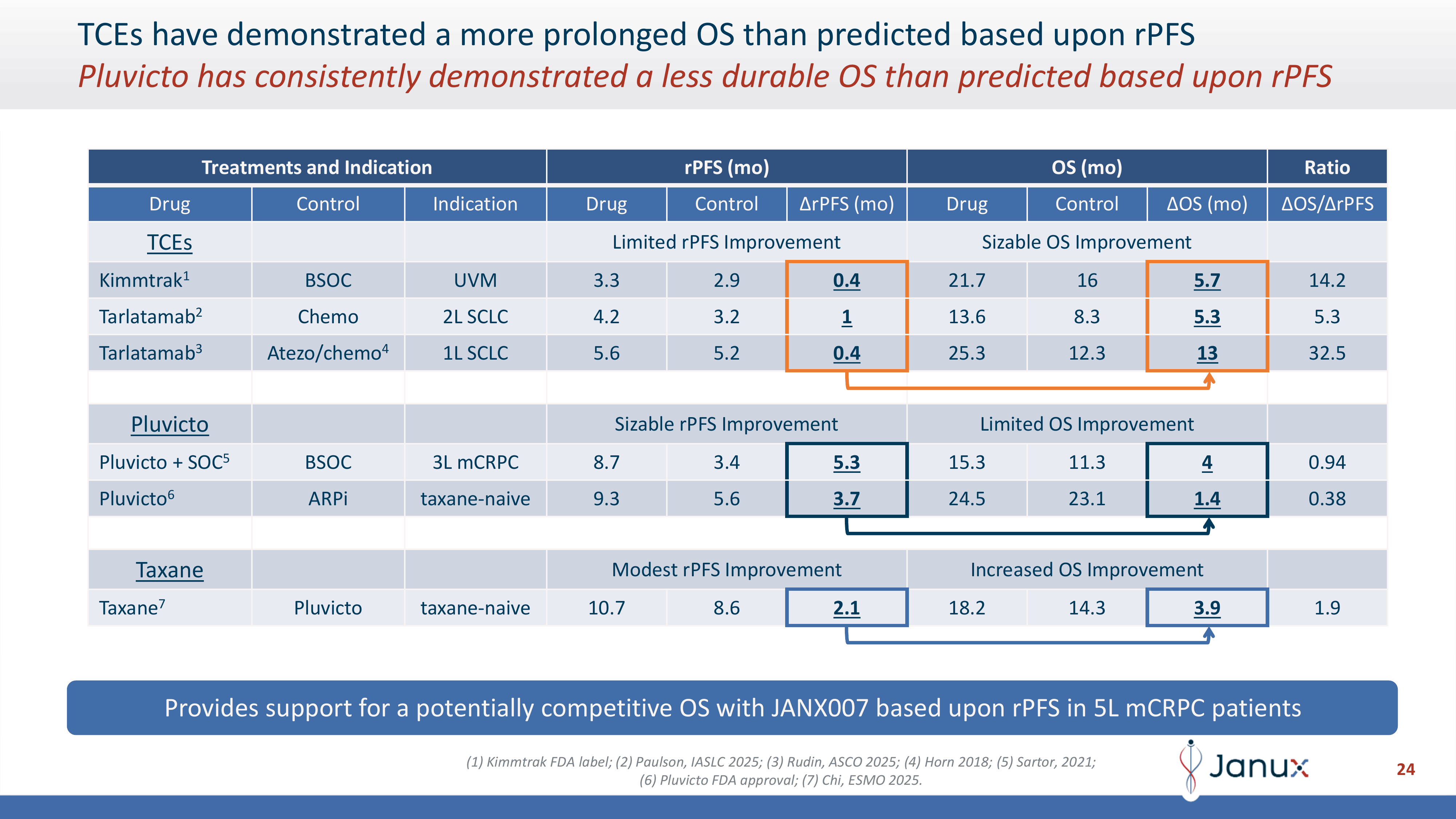

Finally, we must address the valuation disconnect. Why buy a drug that has "comparable" progression-free survival (rPFS) to Pluvicto? Because rPFS is likely lying about the true benefit.

- The Pattern: Drugs like Kimmtrak (uveal melanoma) showed almost no rPFS benefit (3.3 months vs. 2.9 months control) but delivered a massive Overall Survival (OS) benefit (21.7 months vs. 16 months).

- The Mechanism: T-cells create a "memory" immune response that continues to control the cancer even after the scans show "progression."

- The Janux Upside: If JANX007 follows this proven biological pattern, an 8.9-month rPFS could translate into an Overall Survival benefit that far exceeds Pluvicto. In the eyes of the FDA and insurance payers, Overall Survival is the only metric that truly matters.

4. Logistics: The Commercial Checkmate

Even if the efficacy were identical, Janux holds a massive commercial edge: Simplicity.

- Novartis ($NVO): Pluvicto is a radioligand therapy. It requires a complex radioactive supply chain, specialized nuclear medicine facilities, and strict patient isolation protocols (due to radiation). This creates bottlenecks and limits access to major academic centers.

- Janux ($JANX): JANX007 is an off-the-shelf biologic. It does not require radiation shielding or nuclear medicine staff. It can be stored in a standard hospital pharmacy and administered in any community oncology clinic.

- The Verdict: In the real world, the drug that is easier to prescribe and administer often wins the market share war. Janux unlocks the massive community oncology market that Pluvicto struggles to reach.

The Bear Case: Risks to Watch

We must remain objective. The drop in share price removes the "perfection premium," but the risk is not zero.

- The Next Catalyst: All eyes are now on the JANX008 (EGFR-TRACTr) update due by Year-End 2025.

- The Downside: If JANX008 disappoints, the market may label Janux a "one-trick pony," potentially dragging the stock down to its cash value or even below (~$17/share).

- The Upside: If the EGFR asset shows efficacy in solid tumors (lung/colorectal), it validates the entire TRACTr platform as a "plug-and-play" engine, likely triggering a massive re-rating.

Conclusion: A Classic Valuation Dislocation

The market demanded a miracle and received "comparable efficacy with superior biological activity." This disappointment is your opportunity.

Janux first caught my attention when the stock was trading around $25. It skyrocketed, but I missed the ride—and I am glad I did. By staying out of the fray during the pre-data hype, we avoided the crash. Now, the stars have aligned: we are looking at a potentially game-changing asset with a solved safety issue and a clear path to superior survival data, all available at a massive discount.

The thesis has shifted from "Speculative Hype" to "Deep Value." I have already stepped in to buy the panic. While I am long, I will be watching closely to see if the Three-Day Rule supports $JANX as well—if the stock stabilizes over the next 72 hours, it confirms that the emotional selling is finished and the real recovery has begun.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.