The Weight Loss "World War" Expands: New Fronts Open in RNA and Oral Therapies

Two emerging biotechs just became the most attractive acquisition targets in obesity after releasing game-changing Phase 1 and Phase 2 data on December 8th.

While the world has been fixated on the "King Kong vs. Godzilla" battle between Eli Lilly and Novo Nordisk, two emerging challengers—Wave Life Sciences (WVE) and Structure Therapeutics (GPCR)—just dropped data bombs that could reshape the battlefield.

Yesterday, both companies released clinical results that sent their stock prices into the stratosphere, with WVE jumping ~146% and GPCR doubling in value. But for the savvy investor, the headline percentages matter less than the specifics of the data.

Are these companies the next Metsera (MTSR), or are they destined to be crushed by the incumbents?

This article dissects the new data, the strategic implications, and why yesterday’s winners immediately became today’s most attractive acquisition targets.

1. Wave Life Sciences (WVE): The Muscle-Sparing Maverick

Wave Life Sciences has long been known for its RNA editing capabilities and its Duchenne Muscular Dystrophy (DMD) work. But yesterday, they proved they have a "hidden weapon" in obesity: WVE-007.

The Data: Fat Melts, Muscle Stays

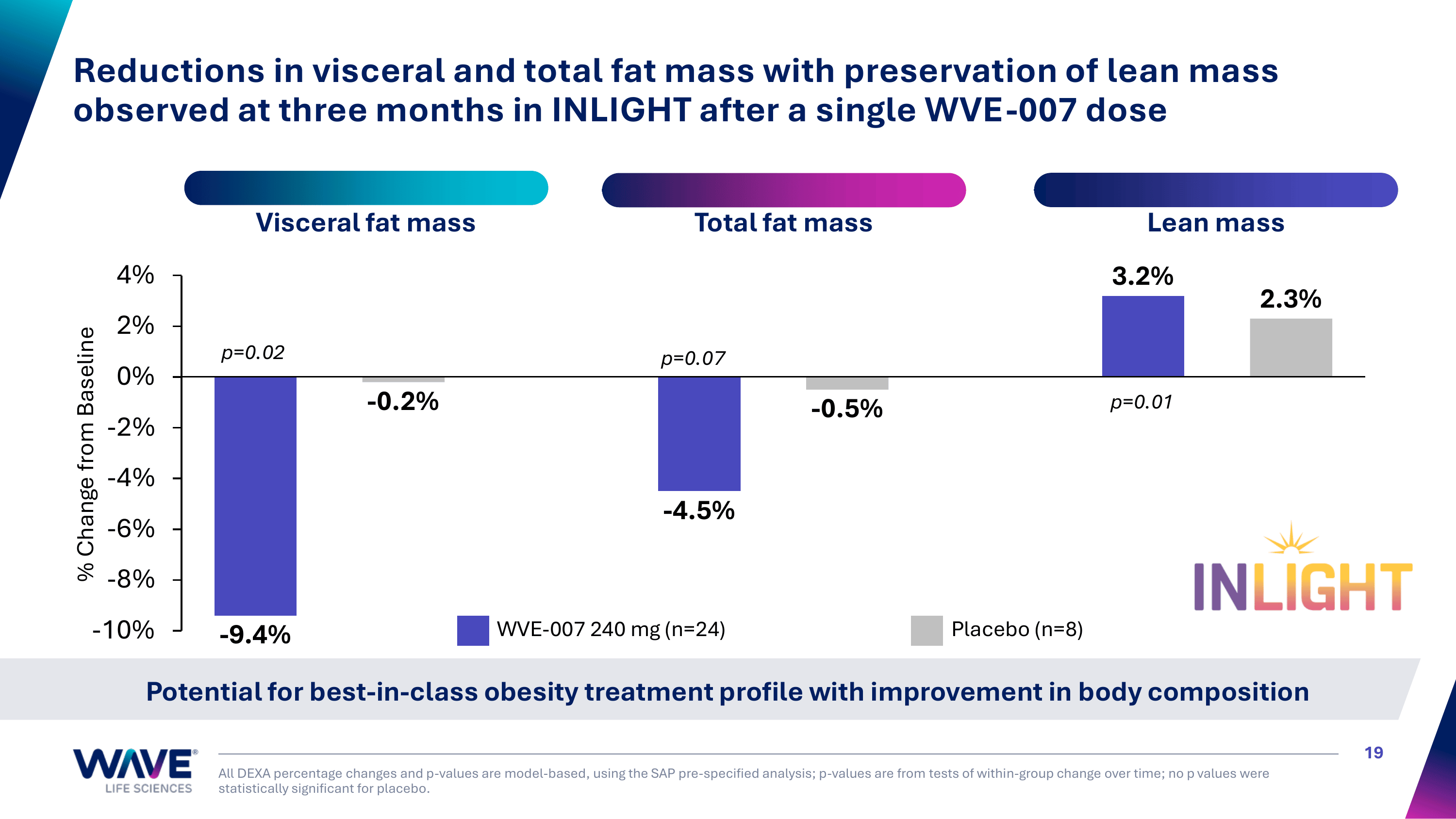

In the Phase 1 INLIGHT trial, WVE-007 (an RNAi therapeutic targeting INHBE) delivered a "holy grail" result that no GLP-1 has perfectly achieved:

- Visceral Fat: -9.4% reduction

- Total Body Fat: -4.5% reduction

- Lean Muscle Mass: +3.2% INCREASE

Why this is disruptive:

Current GLP-1s like Wegovy and Zepbound force patients to trade fat for muscle—up to 40% of weight lost can be lean mass. Wave’s data suggests patients lost only fat while actually gaining muscle. This "quality" of weight loss is the next major battleground.

The Mechanism & Pipeline

WVE-007 works by silencing the INHBE gene, which lowers "Activin E," a protein that regulates fat storage. It’s a completely different mechanism than GLP-1, meaning it could theoretically be combined with Zepbound or Wegovy to supercharge fat loss while protecting muscle.

Don't Forget the Core Assets:

Wave isn't just an obesity pony.

- DMD (WVE-N531): Their exon-skipping candidate for Duchenne Muscular Dystrophy recently showed positive Phase 2 data with sustained dystrophin restoration. The FDA has confirmed an accelerated approval pathway is open, with an NDA planned for 2026.

- RNA Editing: They remain a leader in GalNAc-RNA editing with WVE-006 (AATD) and the newly selected WVE-008 (PNPLA3) for liver disease.

Acquisition Verdict: High.

A big pharma player (Amgen? Pfizer?) could buy Wave not just for the obesity asset, but to acquire a premier RNA/GalNAc platform that rivals Alnylam’s.

2. Structure Therapeutics (GPCR): The Oral Challenger

Structure Therapeutics is fighting a different war: the race for the Oral Pill. Injectables are hard to manufacture and harder to sell to needle-phobic patients. The prize is a pill that works as well as a shot.

The Data: Closing the Gap with Injectables

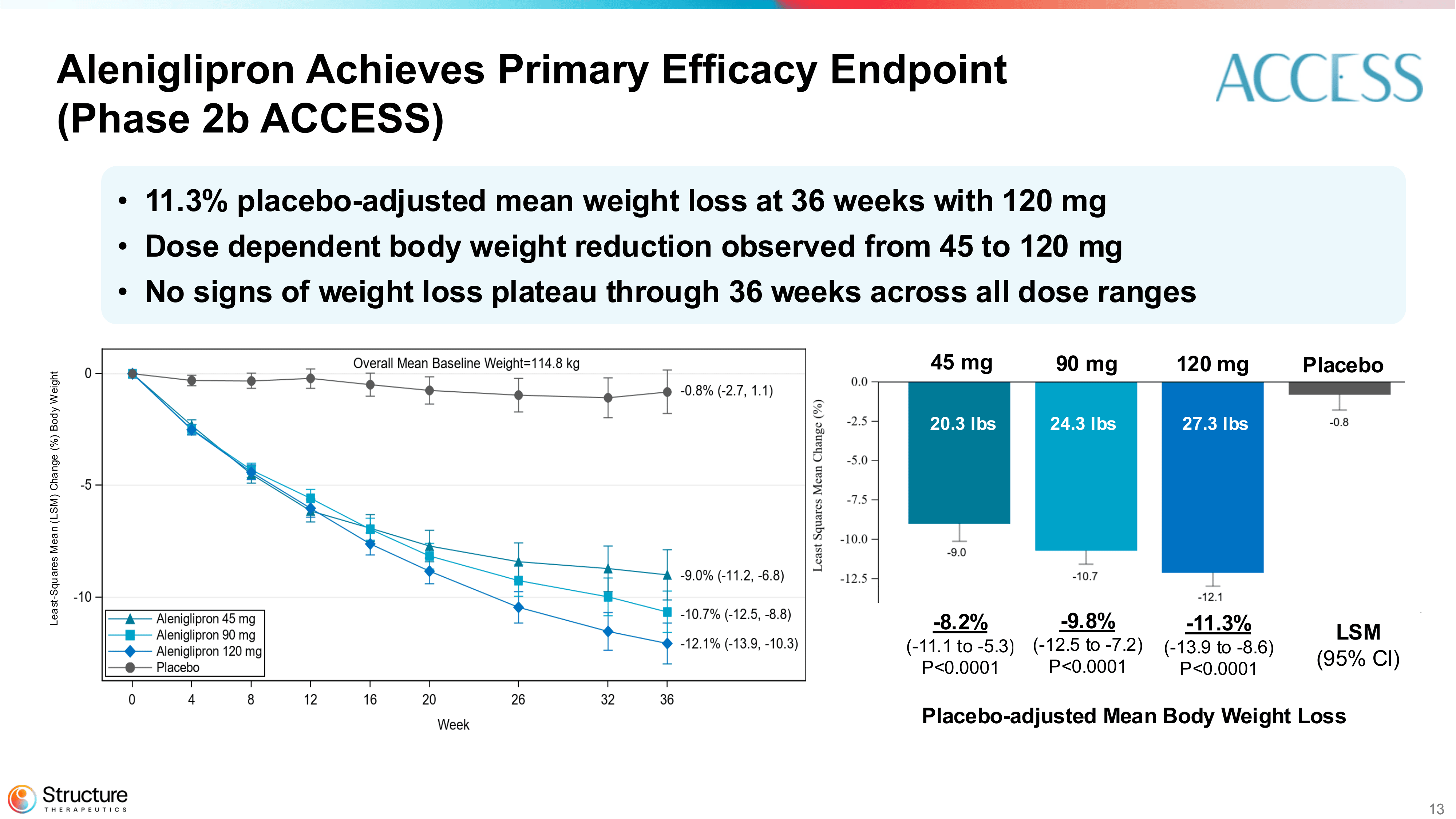

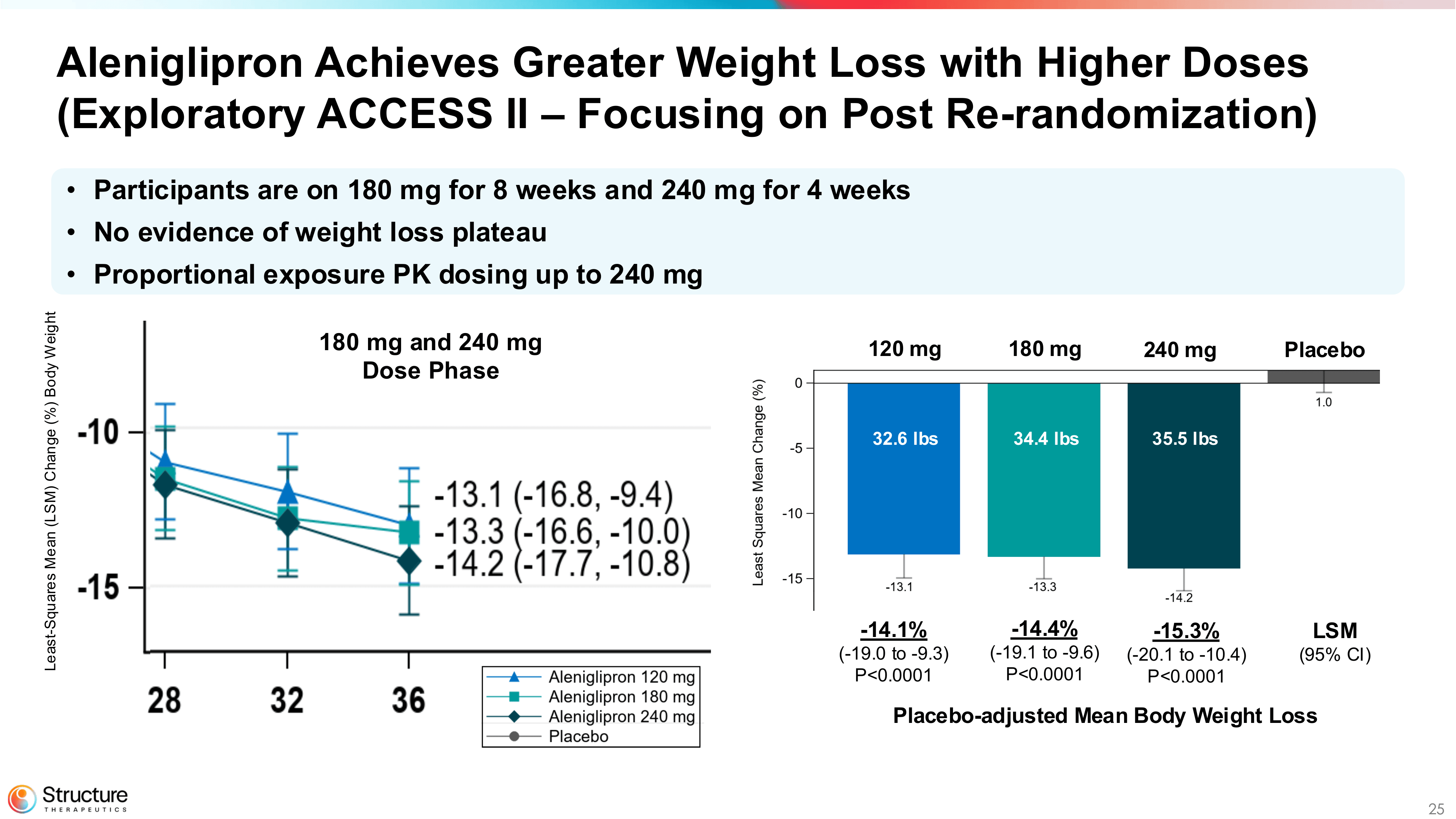

In the Phase 2b ACCESS study and the exploratory ACCESS II study, their oral small molecule Aleniglipron posted numbers that demand attention:

- Weight Loss (120mg): 11.3% (placebo-adjusted) at 36 weeks.

- High Dose (240mg): Up to 15.3% weight loss at 36 weeks.

- Plateau? None. Weight was still dropping at week 36.

Significance:

Achieving >15% weight loss with a pill brings them into the elite tier, comparable to injectable Wegovy.

Safety & Scalability

- Safety: No red flags on liver toxicity (a issue that killed Pfizer’s previous oral attempts). Nausea/vomiting were present but manageable with a slower titration (starting at 2.5mg).

- Manufacturing: Unlike peptide-based orals (like Novo's Rybelsus) which are expensive to make, Structure’s drug is a small molecule. It can be manufactured cheaply by the ton. This is critical for global access.

Acquisition Verdict: Very High.

Structure is a "biotech-in-a-box." An acquirer gets a Phase 3-ready oral asset that is unencumbered and scalable. With a market cap still under $5B even after the jump, they are bite-sized for a major player.

3. The Empire Strikes Back: Novo & Lilly Are Not Sleeping

Before jumping to conclusions about buying these challengers, remember who they are facing. The incumbent party has amassed a formidable arsenal of late-stage weapons that are nearing the end of their campaign:

- Eli Lilly (Orforglipron): Lilly’s own oral pill, Orforglipron, has already succeeded in Phase 3 trials (ATTAIN-2, ACHIEVE-3) reported in late 2025. They are preparing for regulatory submission. Structure is playing catch-up to a drug that is essentially "done."

- Novo Nordisk (Amycretin): Novo is aggressively pivoting its oral Amycretin program into pivotal trials after it showed even faster weight loss than Wegovy in Phase 2.

- The Bar is High: For WVE or GPCR to win, they don’t just need to be good; they need to be better or cheaper than what Lilly and Novo will launch in 12-24 months.

4. The Retail Investor Playbook: "Wait for the Dilution"

Here is the cold shower for retail investors.

The "Sell the News" Reality:

When biotech stocks jump 100% in a day, smart management teams do one thing: they raise cash.

- Wave (WVE) immediately announced a $250 Million public offering.

- Structure (GPCR) immediately announced a $500 Million public offering.

Strategy:

While the long-term thesis for both companies is stronger than ever, the market now has to digest hundreds of millions of dollars in new stock (dilution).

- Don't FOMO: History suggests these stocks often pull back in the days following a massive spike + offering.

- Watch the Dip: Let the institutional investors absorb the new shares. Once the offering closes and the stock stabilizes, that is your entry point.

Conclusion

December 8, 2025, proved that the "Weight Loss World War" is far from over.

- Wave (WVE) has opened a new front on Quality (Muscle Preservation).

- Structure (GPCR) has opened a new front on Access (Scalable Orals).

Both are now prime targets for Big Pharma "arms dealers" looking to buy their way into the war. But for the retail investor, patience is the weapon of choice. Wait for the dust (and dilution) to settle before you charge.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.