Weight Loss "World War II" : Beyond Ozempic and Mounjaro

The $1 trillion battleground where pharma giants and scrappy biotechs are fighting for supremacy — and why the real winners may be patients who couldn't afford these drugs before.

Over one billion people on Earth are now living with obesity.

That's not a typo. According to the World Obesity Federation's 2025 Atlas, more than 1 billion people — 880 million adults and 160 million children — have crossed the clinical threshold for obesity (BMI ≥30). Add in the overweight population (BMI 25-30), and the number swells to nearly 3 billion humans carrying excess weight that threatens their health.

And it's getting worse. A March 2025 Lancet study projects that by 2050, 60% of all adults worldwide — 3.8 billion people — will be overweight or obese. The economic toll? An estimated $4 trillion annually in healthcare costs and lost productivity by 2035, representing a 2.9% drag on global GDP.

This is the market opportunity that explains why Eli Lilly made history on November 21, 2025, becoming the first healthcare company ever to reach a $1 trillion market capitalization. The catalyst? A single molecule called tirzepatide, sold as Mounjaro for diabetes and Zepbound for obesity.

In Q3 2025 alone, these two drugs generated over $10 billion in revenue — more than half of Lilly's total quarterly sales. Combined sales for the first nine months of 2025 approached $19 billion, leapfrogging Merck's cancer immunotherapy Keytruda to become the best-selling drug on the planet.

But here's what makes this story compelling for investors: Lilly's dominance isn't guaranteed. What we're witnessing isn't the end of a war — it's the beginning of an even fiercer battle. Call it Weight Loss World War II.

The first war was won by GLP-1 drugs generally. The second war is about who can build the best GLP-1 (and beyond) — the most effective, most tolerable, most convenient, and ultimately most affordable treatment for the world population living with obesity.

This article maps the battlefield: who's winning, who's charging, and which emerging challengers might reshape this $150 billion market by the end of the decade.

The Incumbents: Fortress Lilly and Novo's Counterattack

Eli Lilly: The Trillion-Dollar Juggernaut

Lilly's position looks unassailable on paper. Mounjaro and Zepbound both use tirzepatide, a dual GIP/GLP-1 receptor agonist that delivered a decisive blow to Novo Nordisk's earlier market leadership. In the landmark SURMOUNT-1 trial, tirzepatide achieved 22.5% mean weight loss at 72 weeks — roughly 7 percentage points better than Wegovy's 14.9%.

But Lilly isn't resting. The company is advancing an entire arsenal of next-generation weapons:

Retatrutide (The Triple Agonist): If tirzepatide was a dual threat, retatrutide is a triple one. This investigational drug activates three receptors — GIP, GLP-1, and glucagon — creating what Lilly calls a "triagonist." The glucagon component adds something crucial: it increases energy expenditure, essentially turning up the body's metabolic furnace.

Phase 2 results published in The New England Journal of Medicine were staggering: 24.2% mean weight loss at 48 weeks — and patients hadn't hit a plateau yet. Some analysts project that Phase 3 data could show 26-28% weight loss with longer treatment.

Lilly's TRIUMPH Phase 3 program is now underway across multiple indications: obesity, type 2 diabetes, obstructive sleep apnea, and knee osteoarthritis. If successful, retatrutide could become the first obesity drug to truly rival bariatric surgery outcomes — without the scalpel.

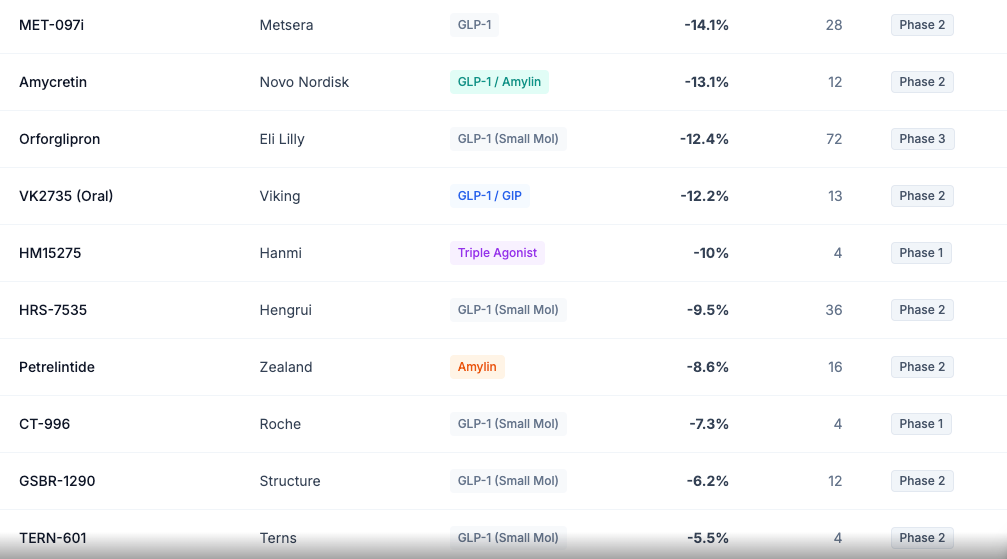

Orforglipron (The Oral Revolution): Perhaps Lilly's most strategically important asset isn't another injectable — it's a pill. Orforglipron is an oral small-molecule GLP-1 agonist that achieved 12.4% weight loss at 72 weeks in the Phase 3 ATTAIN-1 trial.

Why does this matter so much? Manufacturing. The global shortage of Wegovy and Ozempic stemmed partly from the complexity of producing peptide-based injectables. Oral small molecules can be synthesized chemically at massive scale. Orforglipron could democratize access to GLP-1 therapy in ways injectables never could.

Lilly plans to submit orforglipron for FDA approval by year-end 2025, with a potential launch in 2026.

Novo Nordisk: Fighting Back from Behind

Novo Nordisk built the GLP-1 market with Ozempic and Wegovy. But success bred complacency, and Eli Lilly ate their lunch. Novo's stock has lost nearly half its value over the past year as investors watched Lilly grab market share with alarming speed.

Novo's counterattack centers on two major programs:

CagriSema: This weekly injection combines semaglutide (the active ingredient in Wegovy) with cagrilintide, a long-acting amylin analog. Amylin is a hormone that promotes satiety through a completely different brain pathway than GLP-1 — think of it as attacking hunger from two different angles simultaneously.

In December 2024, Phase 3 REDEFINE 1 results showed CagriSema achieved 22.7% mean weight loss at 68 weeks. On paper, this matches tirzepatide. But there's a catch: Novo had internally targeted 25%, and the miss sent shares tumbling nearly 20%.

The market may have overreacted. CagriSema still demonstrates that combining mechanisms can deliver elite efficacy, and 40% of patients lost ≥25% of their body weight — a "super-responder" rate that could attract the most severe obesity cases.

Amycretin (Oral): Novo's answer to orforglipron is amycretin, an oral GLP-1/amylin co-agonist. Early Phase 1 data showed 13.1% weight loss in just 12 weeks — a remarkable trajectory that, if sustained, could deliver injectable-level efficacy in pill form.

Updated Phase 2 data in diabetic patients showed 7.6% placebo-adjusted loss at 36 weeks. While lower than the obesity cohort (diabetics typically show blunted weight loss responses), the trajectory remains competitive.

The Challengers: Who's Charging the Fortress?

The GLP-1 gold rush has attracted everyone from Big Pharma giants to scrappy biotechs. Here's who matters:

Viking Therapeutics (VKTX): The Acquisition Target Everyone's Watching

Viking may be the most strategically valuable unpartnered asset in the entire obesity space. Their drug VK2735 is a dual GIP/GLP-1 agonist (similar mechanism to tirzepatide) being developed in both injectable and oral formulations.

Injectable VK2735: Phase 2 data showed 14.7% weight loss in just 13 weeks — faster than tirzepatide achieved at the same timepoint. The company has now completed enrollment in Phase 3 VANQUISH-1 ahead of schedule, enrolling approximately 4,650 participants (exceeding the 4,500 target). Results are expected in 2027.

Oral VK2735: The oral formulation achieved 12.2% weight loss at 13 weeks — numerically superior to Lilly's orforglipron at the same timepoint. This positions Viking with optionality: either formulation could become a major asset.

Following Pfizer's $10 billion acquisition of Metsera (more on that below), Viking has emerged as the most obvious remaining acquisition target in the space. As one analyst put it, Viking represents a "biotech-in-a-box" — a complete obesity platform (injectable + oral) that any pharma seeking immediate market entry would covet.

The company's Phase 3 program is budgeted at approximately $300 million. With strong cash reserves and rapid enrollment, Viking could be commercially independent — or could command a premium takeout price.

Amgen: The Monthly Dosing Maverick with MariTide

Amgen's obesity drug MariTide (formerly AMG 133) takes a contrarian approach that could prove genius — or could fizzle.

While tirzepatide activates both GLP-1 and GIP receptors, MariTide activates GLP-1 but antagonizes (blocks) GIP. The scientific rationale comes from human genetics: people with natural loss-of-function mutations in the GIP receptor tend to have lower body weight and better body composition.

Phase 2 results showed approximately 20% weight loss at 52 weeks, with no plateau in sight. But MariTide's killer feature isn't efficacy — it's convenience. The drug's extended half-life allows for monthly dosing, potentially improving adherence compared to weekly injections.

Phase 3 trials are now underway. If MariTide can match competitors on efficacy while offering monthly injections, it could capture significant market share among patients who find weekly dosing burdensome.

Altimmune (ALT): The Muscle Preservation Play

Here's a dirty secret about GLP-1 drugs: they cause muscle loss.

When you lose weight rapidly, roughly 25-40% of that loss comes from lean body mass, not just fat. This matters tremendously for long-term health — muscle mass drives metabolism, prevents frailty, and maintains functional independence as we age. The cosmetic concern dubbed "Ozempic face" (gaunt, sunken cheeks) is a visible manifestation of this phenomenon.

Altimmune's pemvidutide is trying to change that equation. This GLP-1/glucagon dual agonist achieved 15.6% weight loss at 48 weeks in Phase 2 — respectable but not chart-topping. However, MRI body composition analysis revealed something remarkable: 78% of the weight lost was fat, with only 22% from lean mass.

Compare that to semaglutide, where some studies show 40% lean mass loss. Pemvidutide's glucagon component increases energy expenditure (similar to exercise), which may explain the superior fat-targeting.

For elderly patients, those concerned about "skinny fat" outcomes, or athletes wanting to optimize body composition, a muscle-sparing GLP-1 could command premium positioning.

Boehringer Ingelheim/Zealand Pharma: The MASH Crossover with Survodutide

Survodutide is a GLP-1/glucagon dual agonist (similar mechanism to pemvidutide) that achieved approximately 18.7% weight loss at 46 weeks in Phase 2. The drug is now in Phase 3.

What makes survodutide strategically interesting is its positioning for MASH (metabolic dysfunction-associated steatohepatitis) — the fatty liver disease epidemic that affects millions of Americans. Glucagon agonism directly promotes liver fat oxidation, making survodutide potentially more effective for MASH than pure GLP-1 drugs.

This MASH angle has become a major battleground, triggering a wave of M&A that we'll explore below.

Roche: The Late Entrant with Deep Pockets

Roche has entered the obesity race through multiple channels:

CT-388 (Injectable): This dual GLP-1/GIP agonist showed 18.8% weight loss in just 24 weeks during Phase 1b/2a — the fastest rate of weight loss observed in any publicly available data. If this velocity translates to Phase 3, Roche could have a best-in-class asset.

CT-996 (Oral): Roche's oral small-molecule GLP-1 achieved 7.3% weight loss in only 4 weeks during Phase 1 — another impressive velocity signal. Unlike oral semaglutide (Rybelsus), which requires strict fasting conditions, CT-996 has no food timing restrictions.

Combined with Roche's recent $3.5 billion acquisition of 89bio for MASH, the company is clearly making a major strategic bet on metabolic disease.

The M&A Feeding Frenzy: $20+ Billion in Deals

The obesity/metabolic space has witnessed an unprecedented M&A wave in late 2025:

Pfizer's $10 Billion Metsera Gamble

The Metsera saga became a corporate soap opera. In September 2025, Pfizer announced a $4.9 billion acquisition of the clinical-stage company. Then Novo Nordisk swooped in with an unsolicited $10 billion counter-bid. Legal threats flew. The FTC got involved. And ultimately, Pfizer won by matching Novo's price — $10 billion (up from $4.9 billion) for a company with no approved products.

Why the frenzy? Metsera's lead candidate, MET-097i, is a monthly injectable GLP-1 that achieved 14.1% placebo-adjusted weight loss at 28 weeks in Phase 2. Monthly dosing is a massive differentiator. But Metsera also has MET-233i, an amylin analog showing 8.4% weight loss in just 36 days in early trials — suggesting potent combination potential.

Pfizer desperately needed this deal. The company abandoned two internal oral GLP-1 candidates (lotiglipron and danuglipron) due to liver toxicity concerns. Metsera gives Pfizer a credible path back into the market.

The MASH Acquisition Spree

Obesity and liver disease are intimately connected — fatty liver is one of the most common complications of obesity. This connection has triggered a parallel M&A wave:

Roche acquired 89bio for up to $3.5 billion (September 2025) to obtain pegozafermin, an FGF21 analog in Phase 3 for MASH.

Novo Nordisk acquired Akero for $4.7 billion (October 2025) — their largest R&D acquisition ever — to obtain efruxifermin, a competing FGF21 analog that beat semaglutide in Phase 2b trials.

GSK acquired Boston Pharmaceuticals' FGF21 asset for $1.2 billion (May 2025).

The common thread? FGF21 analogs reduce liver fat and inflammation through mechanisms distinct from GLP-1s. Combining these drugs with weight loss therapies could create comprehensive metabolic disease platforms.

Who's Next?

After Metsera's takeout, Viking Therapeutics sits alone as the most obvious remaining target. Structure Therapeutics (oral GLP-1) and Zealand Pharma (amylin/petrelintide) could also attract acquirer interest.

The Metsera bidding war established a key valuation benchmark: pharma companies will pay 3-4x forward revenues for de-risked obesity assets with differentiated profiles (monthly dosing, oral, combination potential).

The Side Effect Problem: Why "Better" Isn't Just "More Weight Loss"

For all the efficacy excitement, current GLP-1 drugs have real limitations that create openings for challengers:

Gastrointestinal Misery

In clinical trials, 44% of Wegovy patients experienced nausea, 30% had diarrhea, and 24% vomited. While these side effects typically diminish after the dose-escalation period (usually 4-5 months), they drive meaningful discontinuation. Only 38% of patients remain on treatment at 12 months in real-world data.

The business implication: any drug that achieves comparable efficacy with better GI tolerability has a major competitive advantage. This is why Zealand Pharma's petrelintide (a pure amylin analog with almost no nausea in Phase 1b) and Amgen's MariTide (which uses slower titration to reduce GI events) are worth watching.

Muscle Loss and "Ozempic Face"

As discussed, 25-40% of GLP-1-induced weight loss comes from lean body mass. This creates both health concerns (loss of metabolic reserve, frailty risk in elderly patients) and cosmetic concerns (facial volume loss, loose skin).

The muscle preservation race is intensifying:

Pemvidutide (Altimmune): 78% fat loss / 22% lean mass loss — best-in-class.

Bimagrumab combinations (Eli Lilly/Versanis): Lilly acquired Versanis and its muscle-preserving antibody bimagrumab. In the BELIEVE trial, combining bimagrumab with semaglutide resulted in 92.8% of total weight loss coming from fat — essentially eliminating muscle loss entirely.

MariTide (Amgen): The GIP antagonist mechanism may inherently improve body composition, though detailed data is still emerging.

Weight Regain Upon Stopping

Perhaps the most sobering reality: patients who stop GLP-1 drugs regain most of their lost weight. The STEP 1 extension study showed patients who stopped semaglutide regained two-thirds of their weight loss within 12 months.

This positions obesity as a chronic disease requiring chronic treatment — great for recurring revenue, but challenging for patient acceptance and payer economics.

The Affordability Question: When Will Prices Fall?

Current list prices are eye-watering: Wegovy costs $1,349-1,821 per month; Zepbound runs approximately $1,023-1,200. Manufacturing cost analysis suggests these drugs could be produced profitably for under $5 per month.

Several forces are converging to drive prices down:

Medicare Coverage: The November 2025 Trump administration deal brought Medicare coverage of GLP-1s for obesity starting mid-2026, at a negotiated price of $245 per month with a $50 patient copay. This affects roughly 10% of Medicare beneficiaries (those with BMI >35 or overweight with specific conditions).

Oral Alternatives: Orforglipron, oral VK2735, and oral amycretin can be manufactured at dramatically lower costs than peptide injectables. Competition among these orals could create genuine price pressure.

Asian Competition: Chinese companies are developing "fast-follower" GLP-1 drugs for their domestic market and potentially global export. Hengrui's HRS-9531 achieved 19.2% weight loss at 48 weeks — rivaling tirzepatide. Innovent's mazdutide has already beaten semaglutide head-to-head in a Chinese Phase 3 trial.

While these drugs currently target Asian markets, biosimilar competition and international pricing benchmarks will eventually exert downward pressure on U.S. prices.

The Emerging Far East Challenge

Speaking of Asia, Western investors shouldn't ignore the innovation emerging from Chinese and Korean pharma:

Hengrui/Kailera (HRS-9531)

Hengrui Medicine, China's largest domestic pharma, spun out its metabolic assets to Kailera Therapeutics for global development. Their dual GIP/GLP-1 agonist HRS-9531 achieved 17.7-19.2% weight loss at 48 weeks in Chinese Phase 3 trials — essentially matching tirzepatide.

Kailera is positioning for U.S. development, which could create another competitor in the late-2020s timeframe.

Hanmi Pharmaceutical (HM15275)

The Korean company Hanmi has pioneered long-acting peptide technology (LAPSCOVERY platform). Their next-generation triple agonist HM15275 showed up to 10% weight loss in just 4 weeks in Phase 1 data presented at ADA 2025 — an explosive rate that suggests potent pharmacology.

Hanmi's molecules have historically been licensed to Western partners (they originally developed tirzepatide's precursor technology), so HM15275 could eventually reach U.S. patients through a licensing deal.

Innovent Biologics (Mazdutide)

Innovent's mazdutide (developed with Lilly) is a GLP-1/glucagon dual agonist that achieved 18.6% weight loss at 60 weeks in Chinese Phase 3. More importantly, the DREAMS-3 trial was the first head-to-head Phase 3 comparing a dual agonist to semaglutide — and mazdutide won on both weight loss and glycemic control.

While mazdutide is focused on the Chinese market, the trial validates that dual agonism is superior to GLP-1 monotherapy across diverse genetic populations.

Future Trends: Where the Battlefield is Heading

Looking beyond current candidates, several trends will shape the next decade:

1. Efficacy Ceiling Rising Toward Surgical Outcomes

Retatrutide's 24%+ weight loss already approaches gastric sleeve results (typically 25-30% excess weight loss). As Phase 3 programs mature, we may see pharmacological options that genuinely replace bariatric surgery for most patients — without the surgical risks, irreversibility, or nutritional complications.

2. Combination Therapy Era

Single-agent therapy may give way to rational combinations:

- GLP-1 + amylin (CagriSema model)

- GLP-1 + glucagon (retatrutide, pemvidutide model)

- GLP-1 + muscle-preserving agents (bimagrumab combinations)

- GLP-1 + MASH therapies (FGF21 analogs)

The optimal "cocktail" for different patient phenotypes remains to be determined.

3. Oral Dominance for Maintenance

The likely treatment paradigm: initiate weight loss with potent injectables (potentially triple agonists), then transition to oral maintenance therapy for long-term adherence. This "step-down" approach could optimize both efficacy and convenience.

4. Quality Over Quantity

The focus is shifting from "how much weight can we lose?" to "what kind of weight are we losing?" Body composition, cardiovascular outcomes, liver health, and functional status will increasingly differentiate drugs with similar headline weight loss numbers.

The Investment Landscape: Who Wins?

For investors evaluating this space, several frameworks help:

Lilly remains the incumbent to beat. Their tirzepatide franchise, retatrutide pipeline, and orforglipron oral option create a nearly complete platform. The $1 trillion market cap prices in considerable success, but the pipeline depth justifies premium valuation.

Viking is the highest-upside acquisition bet. Phase 3 enrollment is complete, multiple formulations are advancing, and the Metsera bidding war established a clear takeout floor. The risk: Viking may choose to go it alone.

Amgen's MariTide offers differentiation. Monthly dosing is a genuine convenience advantage. If Phase 3 confirms Phase 2 efficacy, MariTide could capture meaningful market share.

Altimmune's muscle-preservation niche may attract specific acquirer interest (fitness-focused consumer companies? Longevity-focused players?), though standalone commercial prospects are less certain.

Pfizer/Metsera is a bet on execution. Pfizer has the commercial infrastructure but needs to prove it can execute in a market where Novo and Lilly have established brands and patient trust.

Conclusion: Why This Matters Beyond Investing

Step back from the stock tickers for a moment.

Obesity is not merely a cosmetic concern or lifestyle choice. It's a chronic, progressive disease that drives type 2 diabetes, cardiovascular disease, fatty liver disease, sleep apnea, certain cancers, and joint destruction. The WHO estimates that 3.7 million deaths annually are directly attributable to high BMI — more than die in road traffic accidents. The CDC estimates that obesity-related medical costs in the U.S. alone approach $173 billion annually.

The scale of the problem is staggering: over 1 billion people currently living with obesity, projected to reach 1.5 billion by 2035. By 2050, a majority of humanity — 3.8 billion adults — will be overweight or obese if current trends continue. This isn't just a rich-country problem anymore; sub-Saharan Africa's obesity rates are projected to increase by 255% by 2050.

For decades, we told patients to "eat less and exercise more" — advice that fails for the vast majority due to powerful hormonal and neurological drives that evolved over millions of years to prevent starvation, not to navigate modern food environments.

The GLP-1 revolution represents the first time we've had pharmacological tools that genuinely address this biological reality. These drugs don't just help patients lose weight temporarily — they appear to reset appetite, improve metabolic health across multiple organ systems, and reduce hard cardiovascular outcomes.

The intense competition we've mapped in this article — Lilly vs. Novo vs. Pfizer vs. Viking vs. Amgen vs. dozens of others — will ultimately benefit patients. Competition drives innovation (better efficacy, fewer side effects, more convenient dosing). Competition drives access (oral alternatives that can be manufactured at scale). And eventually, competition drives affordability.

Ten years from now, effective obesity treatment may be as routine and accessible as blood pressure medication is today. The current war is about who captures the value during this transition — but the transition itself is enormously positive for human health.

For BiostockInfo readers evaluating this space: the market is huge, the science is advancing rapidly, and the competitive dynamics create both risk and opportunity. The winners won't necessarily be the companies with the highest Phase 2 efficacy numbers — they'll be the ones who solve the full equation: efficacy + tolerability + convenience + affordability + sustainable manufacturing.

That's a complex equation. But with $150 billion in projected annual sales by 2030, there's plenty of room for multiple winners.

Disclaimer

The information provided on this website is for informational purposes only and should not be construed as

financial, investment, legal, or professional advice. While efforts are made to ensure accuracy, no guarantee

is given regarding completeness or reliability. Visitors should conduct their own research or consult a qualified

advisor before making any decisions. External links are provided for convenience and do not imply endorsement.